What to Know:

- James Chanos closed his $MSTR/$BTC short position, a sentiment shift that often precedes broader risk-on phases for investors.

- Strategy added 397 $BTC last week, reinforcing the corporate DCA bid beneath Bitcoin’s price action.

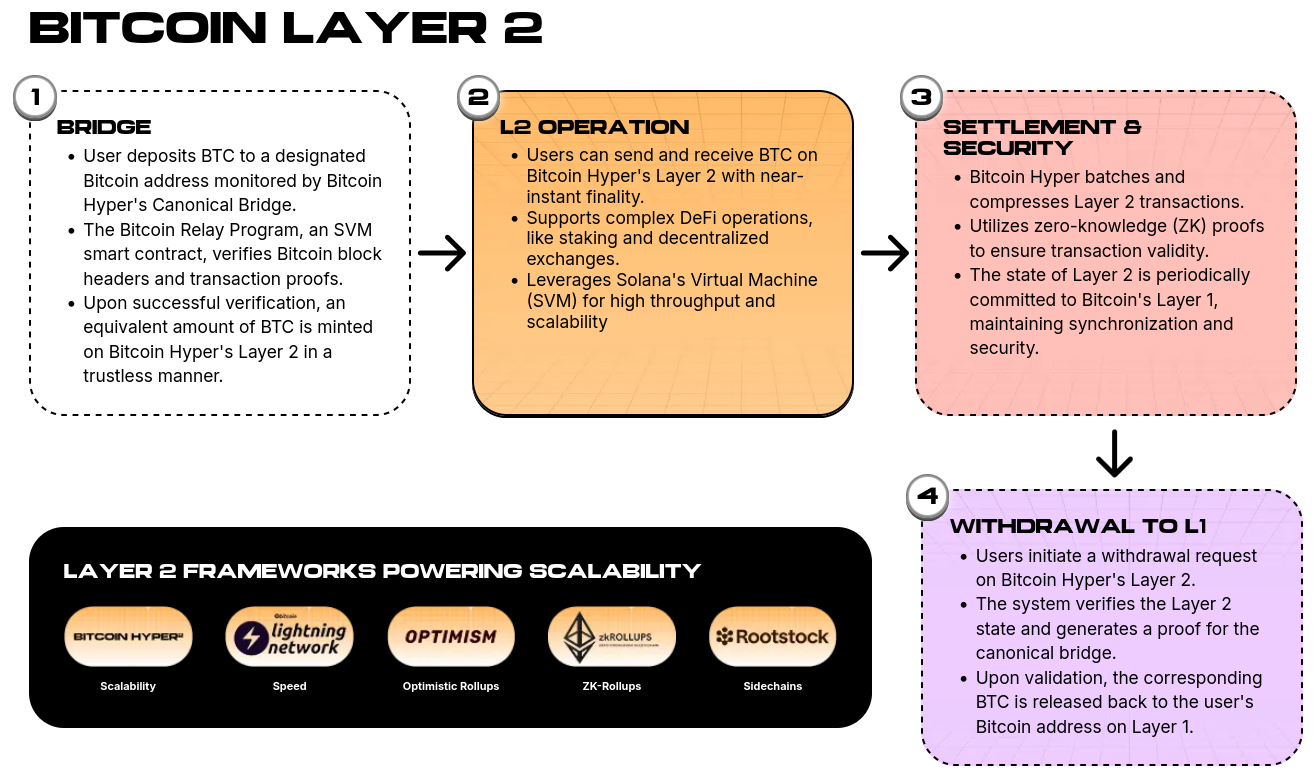

- Bitcoin Hyper maps a canonical bridge + SVM design to bring speed to $BTC while anchoring settlement on L1 for added security.

- The presale has raised around $26.4M with 44% staking yields, and the price is at $0.013245. It will increase in the next seven hours.

A closely watched bear bet just blinked. Renowned short seller James Chanos has closed his 11-month $MSTR/$BTC hedge, signaling a shift in the trade that’s defined the downcycle for Bitcoin-exposed equities.

Bears don’t give up easily, but when they do, they often have an outsized impact on the market. That shift matters for traders who’ve been waiting for a cleaner macro tape to let crypto beta breathe.

Plus, momentum in Bitcoin treasuries adds weight to the narrative. Michael Saylor’s Strategy added another 397 $BTC last week, lifting its stack to 641,205 $BTC while continuing to tap capital markets.

Corporates using dollar-cost averaging at six figures per coin is the opposite of capitulation; it’s an institutional bullish case. If the short-side thesis is disappearing while balance-sheet buyers keep buying, the bear narrative might become a thing of the past soon.

Chanos’ exit also came as the premium between Strategy’s equity and its underlying $BTC narrowed hard, and that’s one reason the hedge made less sense to maintain.

For traders watching risk rotations, that’s the setup where liquidity fans out to higher-beta names and fresh narratives.

In that environment, projects that aim to upscale Bitcoin’s speed and programmability, like Bitcoin Hyper ($HYPER), tend to stand out.

📚 Learn more about Bitcoin Hyper in our comprehensive review.

Bitcoin Hyper ($HYPER) – $BTC Security, SVM-Speed, L2 Upscaling

Bitcoin Hyper’s thesis is straightforward: keep Bitcoin as the settlement bedrock while shifting throughput to an SVM execution layer that feels near-instant.

$BTC’s real-time transaction speed averages just seven TPS, far from the likes of Solana’s ~700 TPS. So, $BTC’s chain is extremely slow, so much so that it’s almost unusable for most modern DeFi demands.

Bitcoin Hyper wants to change that.

Its architecture features a Canonical Bridge that takes your $BTC and mints wrapped $BTC on a Layer-2 that processes fast transactions, then batches updates back to Layer-1 with zero-knowledge commitments.

In plain English: you get Bitcoin’s credibility with modern performance, opening the door to payments, DeFi, and dApps without leaving the $BTC orbit.

The full ecosystem involves easy deposits, fast-lane execution, periodic settlement, withdrawal, plus a token model where $HYPER powers gas, staking, and governance.

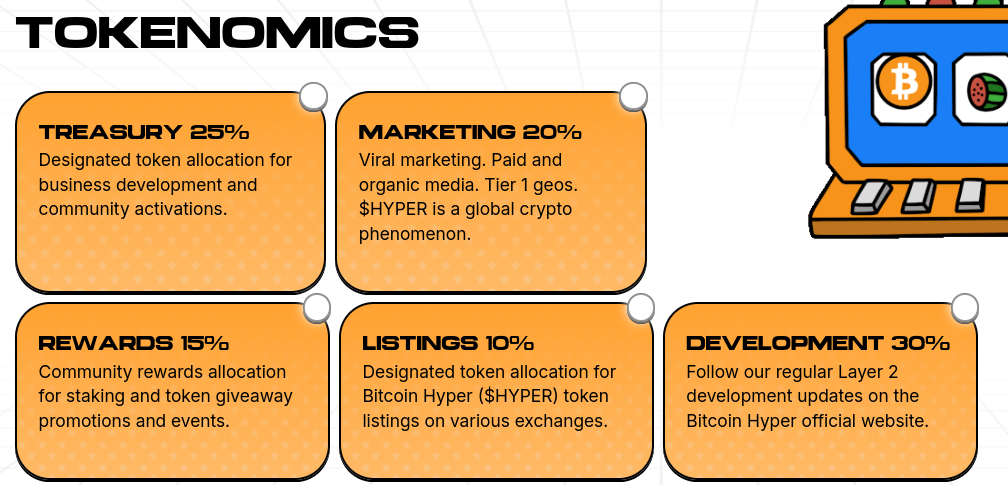

$HYPER’s tokenomics reads like a typical bootstrapping plan (development, rewards, listings, marketing, and treasury) aimed at scaling slowly and methodically. That’s an important context if you’re tracking sustainability.

But the utility pitch is the real tell: if the Layer-2 actually makes $BTC feel instant and cheap, usage can start to outrun emissions.

Over $26.4M Raised in Viral Presale: Best Altcoin to Buy?

$HYPER’s presale momentum supports the narrative. The total raise has hit $26.4M, fueled by several whale purchases in recent months (including $379K last month).

This is a healthy signal that retail is still willing to fund execution bets tied to Bitcoin if the story is coherent and proves useful.

With a token price of $0.013245 and a staking APY of 44%, investing in $HYPER now is a smart move if you want to get in early.

And our $HYPER price prediction estimates a potential $0.08625 price point by the end of 2026 – that’s a 551% increase from today’s price.

📚 Take a look at our step-by-step guide to buying $HYPER.

‘Pay for utility, not fantasy’ is the tone, which is exactly the kind of framing that lands when the bear fog lifts and the focus shifts back to risk-on moves.

For now, the signals rhyme: a veteran shorter closes shop, corporate balance sheets keep stacking Bitcoin, and $BTC’s infrastructure story moves from forum posts to credible rollup design.

If the bear market is indeed fading, leadership often starts at the top (Bitcoin) and then rotates to the best altcoins out there (Bitcoin Hyper). A $BTC-anchored Layer-2 with a clear technical map and growing presale demand fits that playbook perfectly.

🚀 Get your $HYPER now before the next price increase.

Disclaimer: This is informational, not financial advice. Crypto is volatile; staking rates vary, presales carry execution risk, and timelines can change. Always do your own research.

Authored by Elena Bistreanu, NewsBTC – https://www.newsbtc.com/news/bitcoin-bears-retreat-short-seller-closes-trade-bitcoin-hyper-soars

Source link

Elena Bistreanu

https://www.newsbtc.com/news/bitcoin-bears-retreat-short-seller-closes-trade-bitcoin-hyper-soars/

2025-11-10 09:28:00