BNB, the native cryptocurrency of the BNB chain, has shown signs of stability despite recent price fluctuations. While the price experienced a decline over the past month, June’s price action failed to make a significant impact.

This relative stability can be attributed to the strong backing of long-term holders (LTHs) and the continued growth of BNB’s use cases, particularly within the decentralized finance (DeFi) sector.

BNB Holders Save The Day

Long-term holders (LTHs) are one of the key factors behind BNB’s price stability. These investors, who hold their assets for extended periods, have a considerable influence on the market. In the case of BNB, their minimal activity in selling has proven beneficial for the asset.

Liveliness indicates that LTHs have rarely moved their positions in the last five months, and the consistent decline in the indicator is a sign of the same. The low movement from LTHs helps to prevent major sell-offs, providing crucial support to the price. This stability fosters an environment for gradual recovery and allows BNB to maintain a steady price.

Another crucial factor driving BNB’s price stability is its role within the broader cryptocurrency market. BNB Smart Chain (BSC) has a total value locked (TVL) of $5.95 billion, which significantly contributes to BNB’s ongoing growth and stability.

The BNB network’s dominance in the DeFi space is one of the major advantages over other cryptocurrencies like XRP, which currently lags behind in this sector. With over 900 protocols operating on BSC, BNB’s use case continues to expand, ensuring its ongoing demand in the DeFi market. This increasing usage helps cement BNB’s position as a leading cryptocurrency.

However, XRP’s strength lies in its institutional demand, an area where BNB has yet to gain significant traction. XRP’s appeal among financial institutions and its potential for widespread adoption in cross-border payments make it a strong contender in the market. In the coming months, XRP’s institutional demand could outshine BNB’s DeFi dominance, creating potential challenges for BNB’s long-term growth.

BNB Price Toughs Out Volatile Market

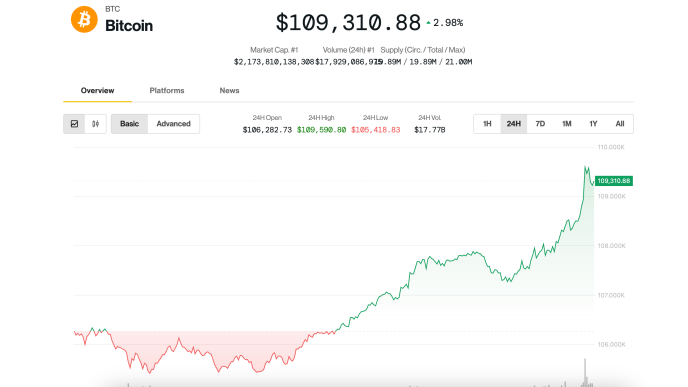

BNB’s price has been relatively stable, sitting at $651 despite market volatility. This stability, with only a 1.5% drop over the month and only 5.6% since the beginning of 2025, is a positive indicator, offering room for recovery. The altcoin has shown resilience in the face of market fluctuations, and a recovery is likely.

However, it is currently facing a micro downtrend that could challenge its upward momentum.

Breaking through this downtrend will be essential for BNB’s continued growth. A key level of support for BNB is at $646, and a bounce off this level could help the cryptocurrency break the resistance at $667. This resistance level has been difficult for BNB to overcome since May, but if the price can flip $667 into a support zone, it could pave the way for further gains.

On the flip side, if the broader market conditions worsen, BNB could see a drop below $646. In this scenario, the next levels of support lie at $628 and $615. If BNB breaks these levels, it could invalidate the bullish outlook, putting its price under pressure and possibly extending the downtrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bnb-price-stability-threaten-xrp/

2025-07-02 16:30:00