Sui (SUI) is attempting to reclaim a key resistance area after recovering from last week’s lows and growing institutional interest in the ecosystem, leading some analysts to suggest that a breakout might be around the corner.

Related Reading

SUI Rallies Amid Ecosystem Interest

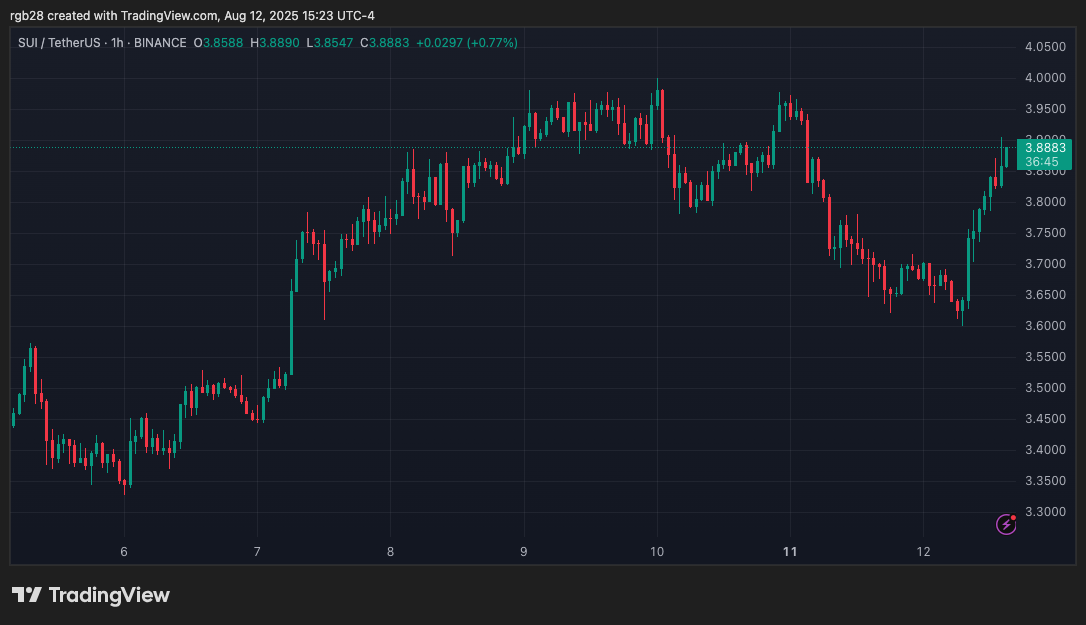

On Tuesday, SUI jumped 7.4% intraday following major news for the ecosystem from institutional players. The cryptocurrency has been attempting to reclaim the $3.90-$4.00 zone over the past few weeks, briefly breaking out during the July market rally.

The altcoin has been trading between $2.33-$4.00 price range since the Q2 recovery, hitting a seven-month high of $4.44 two weeks ago. For most of this period, SUI has hovered within the mid-zone of its multi-month range, failing to reclaim the $4.00 resistance multiple times.

The early August pullback saw the token drop 27% from the local highs before bouncing at the end of last week. Since then, SUI’s price has recovered 20% from this month’s lows, rallying 6.65% in the past 24 hours to the $3.90 area.

On August 12, one of the largest digital asset firms, Grayscale Investments, announced two new products that expand its “existing lineup of Sui Ecosystem products.” Earlier this year, the firm launched its Grayscale Sui Trust, which fueled a 44% rally after the announcement.

Now, the firm has launched the Grayscale DeepBook Trust and the Grayscale Walrus Trust to “offer investors exposure to two key protocols driving innovation within the Sui ecosystem,” affirmed Rayhaneh Sharif-Askary, Grayscale’s Head of Product and Research.

The trusts, which are now open for daily subscriptions for eligible accredited investors, function as Grayscale’s other single-asset investment trusts and are solely invested in the DEEP and WAL tokens, respectively.

SUI’s Price Ready For $10?

Analyst Sjuul from AltCryptoGems noted the cryptocurrency “really likes to move along the 3 drives pattern.” The pattern consists of three consecutive price movements in the same direction, before a trend reversal.

As the chart shows, SUI displayed a bullish 3 drives formation during the November-January rally, which was followed by a bearish 3 drives pattern during the February-April pullback.

Now, the cryptocurrency has been potentially repeating the bullish setup since the May breakout, with the third drive up still ahead. “We should still have one leg left,” the analyst asserted, which could propel SUI’s price to the $5.00 resistance.

Crypto Rand noted that SUI is consolidating after its local breakout, which could target an initial run to the $5.00 mark and a potential rally to an all-time high (ATH) around the $10 barrier.

Related Reading

Similarly, analyst Alex Clay suggested that investors should “not ignore SUI,” as it has a potential cycle top of $11.7. He explained that altcoin displays a strong higher timeframe with a cup and handle formation between 2023 and 2024, followed by a re-accumulation within a 10-month symmetrical triangle.

To the market watcher, the compression period “is over” and a breakout could be imminent in the coming weeks. A confirmed breakout from the $4.00 resistance could kickstart a rally to a new high between the $7.90 and $11.7 area.

As of this writing, SUI trades at $3.91, a 12% increase in the monthly timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com

Source link

Rubmar Garcia

https://www.newsbtc.com/news/sui-set-up-for-another-leg-analyst-forecasts-10-target-for-potential-breakout/

2025-08-13 04:00:00