Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitwise Asset Management has quietly nudged Dogecoin one step closer to Wall Street’s ETF club, filing an amended S-1 on 26 June that for the first time allows “in-kind” creations and redemptions. The tweak is more than procedural. It lines the proposed Bitwise Dogecoin ETF up with the operational playbook the US Securities and Exchange Commission already blessed for spot-bitcoin and spot-ether products, and it signals that SEC staff are now deep in the weeds on the mechanics of custody and settlement.

Signs Point To Dogecoin ETF Approval

“Bitwise has filed amended S-1s for their spot Dogecoin ETF and their spot Aptos ETFs. Good signs as it indicates SEC engagement, and tracks with other spot approvals,” Bloomberg Intelligence senior ETF analyst Eric Balchunas wrote on X. He underscored the importance of the new language: “One HUGE update to the filing is ‘in-kind’ creations and redemptions… Near-lock at this point that in-kind will be allowed in spot ETFs across board.”

Related Reading

The change matters because in-kind processing lets authorized participants swap DOGE directly for ETF shares (and vice versa) without the tax friction and slippage that accompany the cash-only model imposed on futures-based crypto funds. The SEC’s willingness to consider that structure for a dog-branded altcoin would have seemed fanciful a year ago. It now appears consistent with the regulator’s post-bitcoin-ETF détente, during which issuers also sought in-kind redemptions.

Approval odds are converging on the high end of the spectrum. Less than a week ago, Balchunas and fellow analyst James Seyffart raised their probability for “the vast majority” of pending altcoin ETFs—including Dogecoin—to “90 percent or higher,” citing what Seyffart called “very positive” SEC engagement.

Related Reading

Notably, that optimism has not fully washed into prediction markets: on Polymarket, the contract titled “Doge ETF approved in 2025?” was trading around 69% early Friday morning in Europe, while a shorter-dated line for approval by 31 July priced in barely 13% odds.

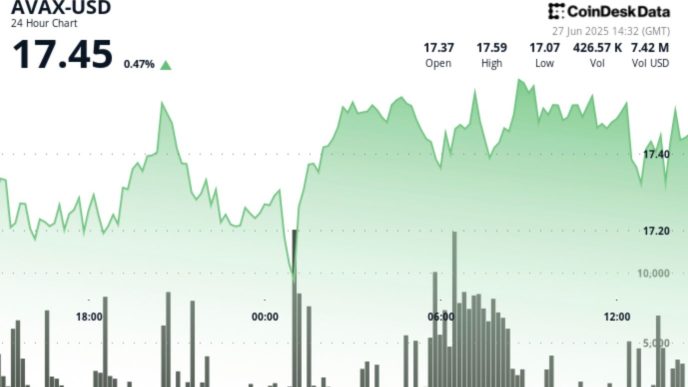

Dogecoin Price Stalls (For Now)

Dogecoin itself has yet to reflect the regulatory tail-wind. The token changed hands near $0.161—down roughly 2% on the day. Technical trader Kevin (@Kev_Capital_TA) argues that bulls still control the longer-term picture: on his weekly chart, DOGE has respected a momentum breakout line traced back to late-2022 on five separate tests, each time spring-boarding into “major bounces.” He pegs the “line in the sand” at the $0.143–0.127 support band: “

Yet Kevin cautions that meme-coin exuberance ultimately hinges on the Federal Reserve, not tweet-driven hype. In a separate post this week, he noted that fresh highs in bitcoin dominance continue to ride “restrictive monetary policy and an uncertain geopolitical environment.” Alt-season, he wrote, will require the end of quantitative tightening and a tangible decline in the US terminal rate—conditions absent since late-2023 and still distant according to Fed-funds futures.

At press time, DOGE traded at $0.16123.

Featured image created with DALL.E, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/news/dogecoin/dogecoin-etf-gains-sec-traction-price-surge-next/

2025-06-27 14:30:11