In brief

- DeFi Development Corp. upsized its latest convertible notes offering to $112 million.

- Shares of DFDV fell about 3% on the day, rebounding after a bigger dip earlier in the day.

- The company will use net proceeds for a prepaid forward stock purchase and SOL accumulation.

Shares of publicly traded Solana treasury company DeFi Development Corporation finished the trading day down following word that the company upsized its latest convertible notes offering to $112 million.

The firm first announced a new convertible notes raise of $100 million on Tuesday before boosting it to $112 million Wednesday, with an option for initial note purchasers to add a further $25 million in the next seven days.

The bulk of the net proceeds from this raise will be used for a prepaid forward stock purchase transaction of around $75 million, intended to allow select investors in convertible notes to hedge their investments.

“The prepaid forward is an instrument that allows the convertible bond investors to synthetically short the stock without shorting shares into the market,” DeFi Development Corp. COO and CIO Parker White told Decrypt. “This also means that if/when the convertible bonds convert into stock, there will not be nearly as much new supply of stock hitting the market, because that stock has already been pre-purchased by DFDV.”

The remaining net proceeds, which could be around $57 million if the investors purchase the additional $25 million in convertible notes, will be used for general purposes and additional Solana purchases.

The firm, which began its Solana treasury strategy in early April, has already accumulated 621,313 Solana or around $95 million via purchases, plus it acquired a Solana validator company. DeFi Development Corp. also raised a $5 billion equity line of credit (ELOC) to help fuel “strategic” Solana purchases.

“A healthy capital structure has multiple types of investors with different risk/return profiles. The convertible bond allows us to raise capital from convertible bond investors, most of whom do not directly buy equity,” said White of the decision to use convertible notes with this raise.

“Convertible bond investors by their nature are more risk-averse, and are willing to trade some upside exposure for some downside protection,” he added. “The equity line of credit, on the other hand, allows us to raise capital from equity investors who want more upside exposure and are OK with more downside risk.”

According to White, raising capital from both types of investors lets the firm maximize the funds it can raise to buy SOL, without diluting shareholders.

Shares of DFDV closed down nearly 3% at $20.39 on Wednesday, still up more than 2,300% year-to-date. The price was down approximately 10% earlier in the day before ticking back up.

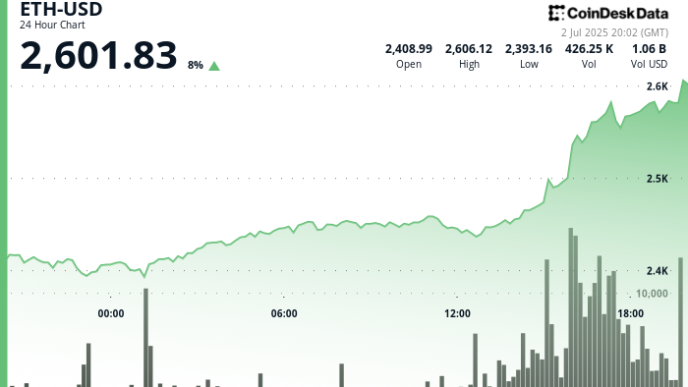

Solana (SOL) is up 5% in the last 24 hours, trading above $152, approximately 48% off its January all-time high of $293.31.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Logan Hitchcock

https://decrypt.co/328281/solana-treasury-firm-defi-dev-boosts-convertible-notes-offering

2025-07-02 20:14:05