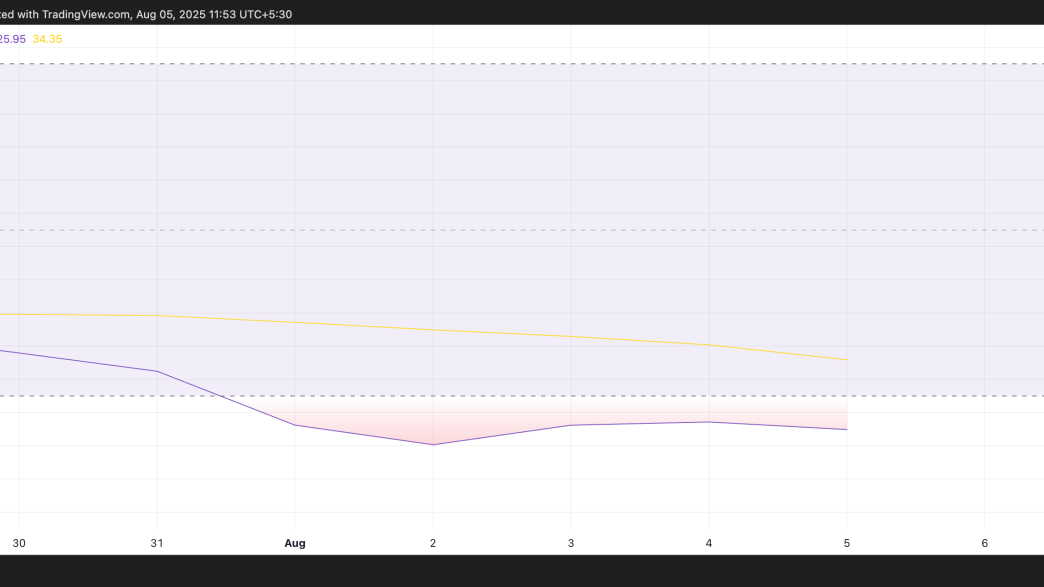

PI Network’s token plunged to a new all-time low on August 1 and has since entered a period of consolidation, showing little movement in either direction.

The lackluster price action reflects a market in limbo, with traders awaiting a decisive move that could set the tone for PI’s next chapter.

PI Price Trapped Between Fear and Hope

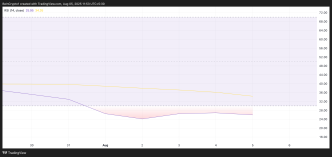

Technical indicators observed on the PI/USD one-day chart confirm this stagnation. For example, PI’s Relative Strength Index (RSI) has trended flatly since the sideways trend began, confirming the relative balance between buying and selling pressures in the market.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

When price action flattens like this, it reflects a struggle between buyers and sellers, with neither side able to push the market decisively higher or lower.

Moreover, PI’s Average True Range (ATR) has trended downward since August 2, confirming the market’s indecision. As of this writing, this indicator stands at 0.03.

The ATR indicator measures the degree of price movement over a given period. When it trends downward like this, volatility is dropping. Price changes are becoming smaller and less frequent.

As with PI, this often happens during consolidation phases, where the market waits for a breakout. It marks periods of uncertainty when traders are not committing strongly in either direction.

Range-Bound PI Eyes Breakout—But Which Way Will It Go?

PI buyers appear hesitant to step in and are wary of further downsides, especially as the project continues to unlock new tokens. Over the next 30 days, 166.21 million PI tokens valued at $59 million at current market prices are set to be unlocked, per PiScan.

If the supply shock from PI’s token unlock continues to weigh on market sentiment, it could break below its range to revisit its all-time low of $0.32.

However, a break to the upside is likely if new demand resurfaces. In this scenario, PI’s price could climb toward $0.44.

The post PI Network Struggles at New Low as Market Awaits Its Next Major Shift appeared first on BeInCrypto.

Source link

Abiodun Oladokun

https://beincrypto.com/pi-price-struggles-at-new-low/

2025-08-05 11:00:00