Bitcoin has broken below the critical $115K support level, reaching a new local low of approximately $112,700. After spending over two weeks consolidating in a tight range, BTC has now exited this phase with bearish momentum, raising concerns across the market. Traders and analysts are closely watching to see if Bitcoin can find strong demand around current levels to stabilize the price and prevent a deeper correction.

Related Reading

Key data from CryptoQuant reveals that Short-Term Holders (STHs) are selling their Bitcoin at a loss, a typical pattern observed during retail capitulation events. Over the past 24 hours, a significant volume of BTC has been sent to exchanges at negative profit margins, signaling that weaker hands are being shaken out of the market. This selling pressure often marks the final stages of a correction phase, where panic-driven exits by STHs create potential accumulation opportunities for long-term investors.

The next few sessions will be crucial, as Bitcoin needs to reclaim the $115K level to regain bullish structure. Otherwise, bears may attempt to drive prices lower, targeting the $110K zone. The market now looks for institutional demand or fresh capital inflows to absorb the ongoing retail-driven sell-off and stabilize the price.

Short-Term Holders Sell Bitcoin At A Loss

According to top analyst Maartunn, over the past 24 hours, 21,400 BTC were sent to exchanges at a loss by Short-Term Holders (STHs). This behavior is typical during Bitcoin drawdowns, where retail investors, driven by fear and emotional reactions to price swings, tend to sell their holdings at a loss. These capitulation events often amplify volatility, as panic selling creates sharp, short-term supply spikes on exchanges.

However, despite this surge in loss-driven selling, on-chain data reveals a contrasting narrative among institutional players. The supply of Bitcoin in Over-The-Counter (OTC) desks continues to shrink, suggesting that large investors are actively buying during this correction. This divergence between retail capitulation and institutional accumulation points to a healthy market reset, where weaker hands exit while stronger hands build positions.

Bitcoin’s momentum is now shifting from bullish caution to bearish fear. The recent breakdown below $115K raises the probability of further downside, with analysts eyeing the $112K level as a key support area. This level holds historical significance as the previous all-time high (ATH) set in May. If BTC finds strong demand at this zone, it could establish a solid foundation for the next bullish leg.

Related Reading

BTC Price Analysis: Breakdown Below Key Support Levels

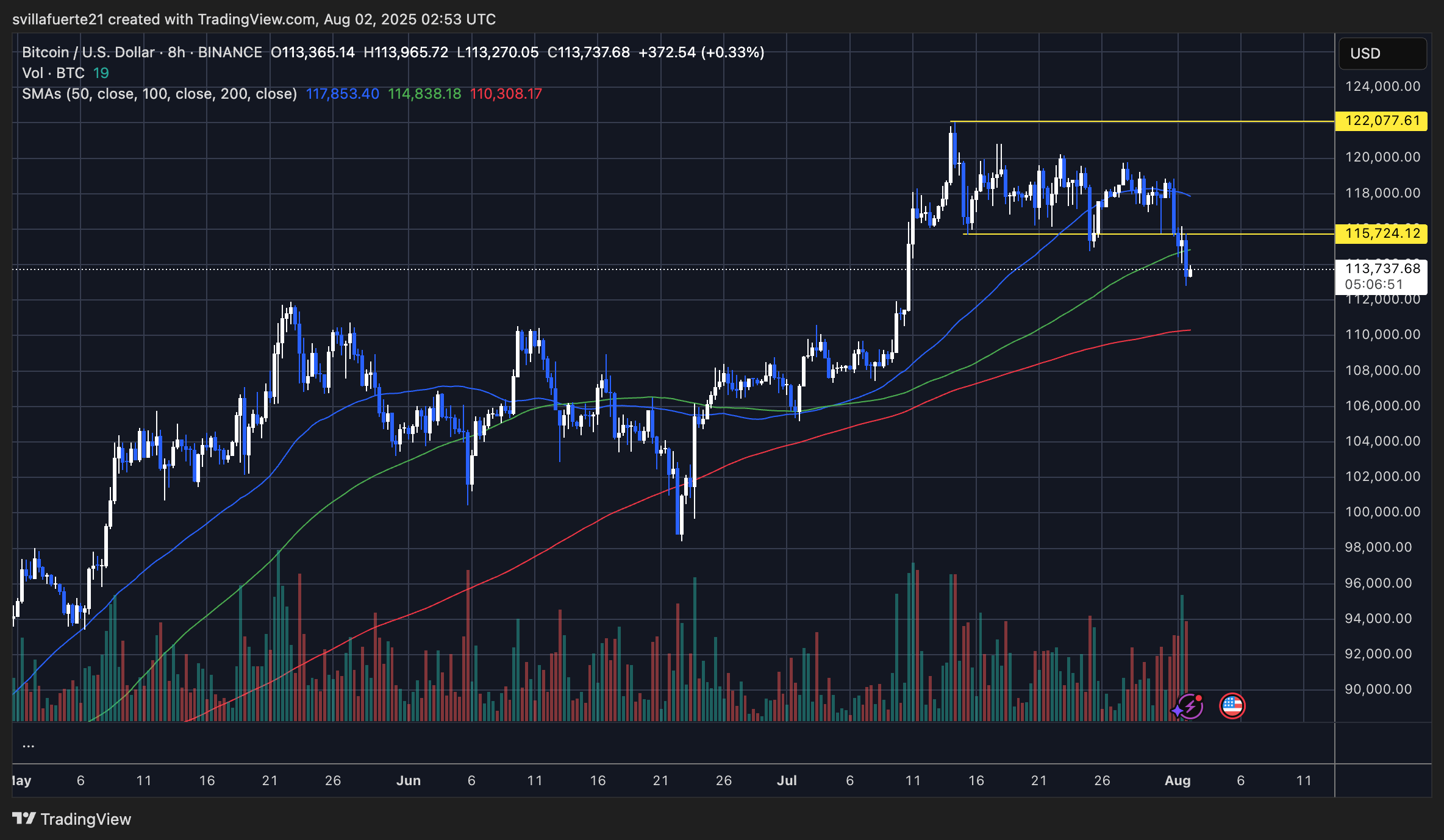

Bitcoin (BTC) has broken down from its multi-week consolidation range, currently trading at $113,737 after losing the critical $115,724 support level. The chart shows a clear rejection at the $122,077 resistance zone, where multiple attempts to break higher failed over the past two weeks. This rejection led to an increase in bearish momentum, pushing the price below the 50 and 100-period SMAs, which are now acting as resistance at $117,853 and $114,838, respectively.

BTC is now hovering just above the 200-period SMA at $110,308, which could act as a last line of defense for bulls. If this level holds, a potential bounce back to retest the $115K region might occur. However, if the price fails to find strong demand soon, the next downside target sits around $112K, which aligns with the previous all-time high from May.

Related Reading

Volume spikes accompanying this breakdown indicate significant selling pressure, likely driven by short-term holders capitulating at a loss. Despite the bearish technical structure in the short term, broader market sentiment remains cautiously optimistic, as institutional accumulation continues in the background. The coming sessions will be critical to determine whether BTC can reclaim $115K or if further downside toward $110K becomes inevitable.

Featured image from Dall-E, chart from TradingView

Source link

Sebastian Villafuerte

https://www.newsbtc.com/bitcoin-news/exchanges-receive-21400-bitcoin-at-a-loss-from-short-term-holders-retail-capitulation/

2025-08-02 15:00:55