Ethereum’s price action is gearing up for a surge of epic proportions, according to crypto technical analyst MasterAnanda on the TradingView platform.

Ethereum has spent a majority of the past two months consolidating above the $2,425 support zone, in what might be an accumulation phase before a major breakout. Nonetheless, MasterAnanda’s analysis suggests that Ethereum is on the verge of entering its strongest bullish wave in years, with a breakout target that starts at $5,791.

Related Reading

Ethereum To Break Out To At Least $5,791

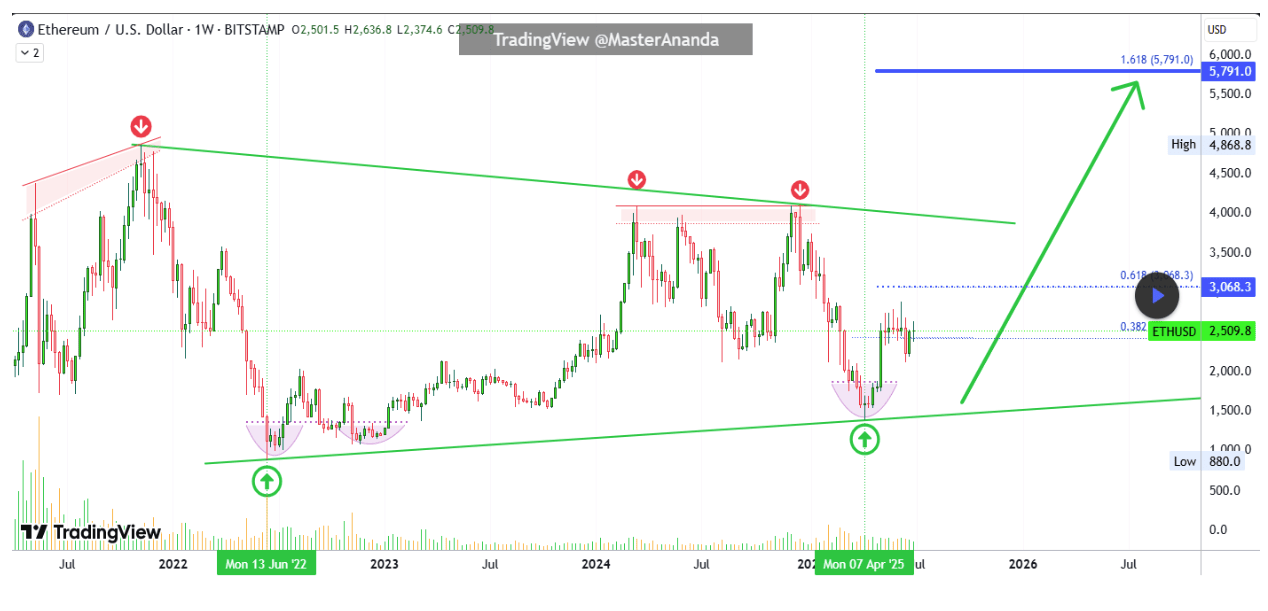

MasterAnanda’s weekly candlestick chart shows a large ETH wedge pattern with consistently rising lows from June 2022 to April 2025. On the other hand, price highs have been relatively flat, specifically around the March and December 2024 peaks. Ethereum’s behavior since April has been marked by low volatility and sideways movement, which often precedes large market moves. The most interesting move was when its price dropped to as low as $1,470 on April 9 before quickly rebounding and establishing a rounded bottom formation.

Nonetheless, the analyst noted that Ethereum is due a major, major bullish wave. The question is not whether it will happen, but when it will. Now that the current consolidation is sitting right above trendline support, MasterAnanda argues that this formation will soon give way to a powerful bullish wave. The target is a minimum of $5,791, which is based on the 1.618 Fibonacci extension.

Interestingly, the analyst noted that it is possible for the Ethereum price to reach $8,500 or higher in the longer term if it breaks above the resistance trendline, which is currently at $4,000. This prediction is backed by improving fundamentals and current on-chain data showing accumulation through Spot Ethereum ETFs.

Wyckoff Accumulation Says It’s Ethereum’s Turn

Crypto analyst Ted Pillows shared a separate but related analysis on the social platform X that’s based on a Wyckoff accumulation pattern playing out on ETH’s weekly chart. Pillows called the selloff to the $1,470 low in April as the “Spring” phase of Wyckoff accumulation, followed by a successful “Test” of a September 2024 support around $2,145, and the gradual move back to resistance now.

According to his projection, Ethereum’s breakout will unfold in stages. The first stage is a push to $3,000, then a correction, followed by a rise to $4,000 in Q3. Only after these steps will the parabolic leg truly begin. The parabolic leg, in this case, should take Ethereum above $5,700, if the price action plays out as predicted.

Related Reading

His analysis closely aligns with MasterAnanda’s call for a minimum $5,791 target. Just as the Wyckoff accumulation pattern pumped Bitcoin to its most recent all-time high, Ethereum may be on the verge of its own spotlight moment in this ongoing 2025 bull cycle.

At the time of writing, Ethereum is trading at $2,516.

Featured image from Unsplash, chart from TradingView

Source link

Scott Matherson

https://www.newsbtc.com/altcoin/ethereum-ready-for-explosive-breakout-5791-the-minimum-target-analyst/

2025-07-06 18:30:00