In brief

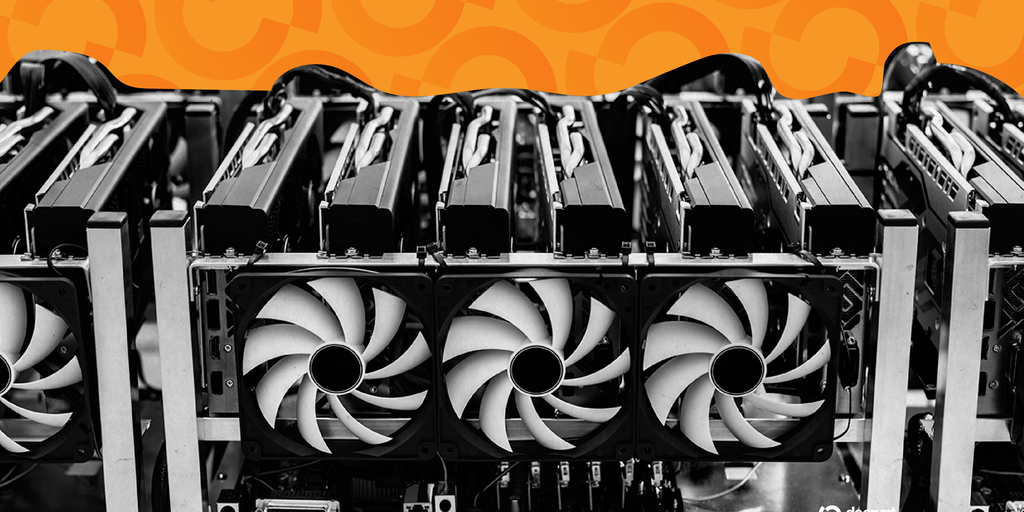

NIP Group, the parent company of esports organization Ninjas in Pyjamas, has acquired an undisclosed number of Bitcoin mining rigs.

The company estimates its mining operation will produce 60 BTC a month, or $6.5 million.

Its stock has fallen 17% since the Tuesday announcement, and is down 88% from its all-time high.

NIP Group, the parent company of iconic esports organization Ninjas in Pyjamas, announced on Tuesday that it is entering the game of Bitcoin mining.

The group is joining the industry through the acquisition of an undisclosed number of Bitcoin mining rigs that have a combined hashrate of 3.11 EH/s—a unit measuring computational power used in Bitcoin mining. NIP Group estimates its mining operation will produce 60 BTC a month, worth approximately $6.5 million at current prices. Of course, this will not be pure profit, as running a Bitcoin mining rig is extremely expensive due to electricity costs.

Alongside this, the company has established a Digital Computing Division that will manage its current and future mining operations, as well as determining what to do with the acquired Bitcoin. NIP Group did not respond to Decrypt’s request for comment on its plans with the acquired BTC.

NIP Group brands itself as an esports entertainment group, but it is most known for the esports team Ninjas in Pyjamas, which competes at the top level in Valorant, League of Legends, Rocket League, and more. From 2012 to 2013, its Counter-Strike: Global Offensive team went on an 87-win streak—a record that remains unbroken and highly respected.

“Not just a gaming company anymore”

Founder and co-CEO of NIP Group, Hicham Chahine, said on LinkedIn that following the company going public last year, it has been looking for new ways to generate revenue outside of esports and entertainment. Bitcoin mining was seen as a sufficiently relevant and adjacent vertical to tackle, he added that further mining expansion is on the horizon.

That said, NIP Group’s stock has fallen 17% to $2.13 since the Tuesday announcement, according to TradingView. It is now down 88% from its all-time high of $17.76, hit in July 2024.

“We’re not just a gaming company anymore,” Chahine wrote on LinkedIn. “We are becoming a next-gen digital infrastructure company built for the entertainment era. Bringing in real computing power. Real operators. Real capabilities.”

The move comes amid a wave of public companies creating crypto-based treasuries and reserves, following the model that made Strategy, formerly MicroStrategy, so successful.

Led by Michael Saylor, Strategy turned itself around from a fairly average business intelligence software solutions company to one of the most sought-after stocks on the market—surging more than 3,300% from its first Bitcoin purchase. The firm now owns more than $65 billion worth of Bitcoin, according to Saylor tracker.

While the treasury trend sweeps the crypto industry, some experts have warned that it could spell disaster if firms are forced to sell.

GG Newsletter

Get the latest web3 gaming news, hear directly from gaming studios and influencers covering the space, and receive power-ups from our partners.

Source link

Ryan Gladwin

https://decrypt.co/328603/esports-giant-ninjas-in-pyjamas-buys-bitcoin-miners-expects-monthly-production-of-6-5m-in-btc

2025-07-04 13:46:05