Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

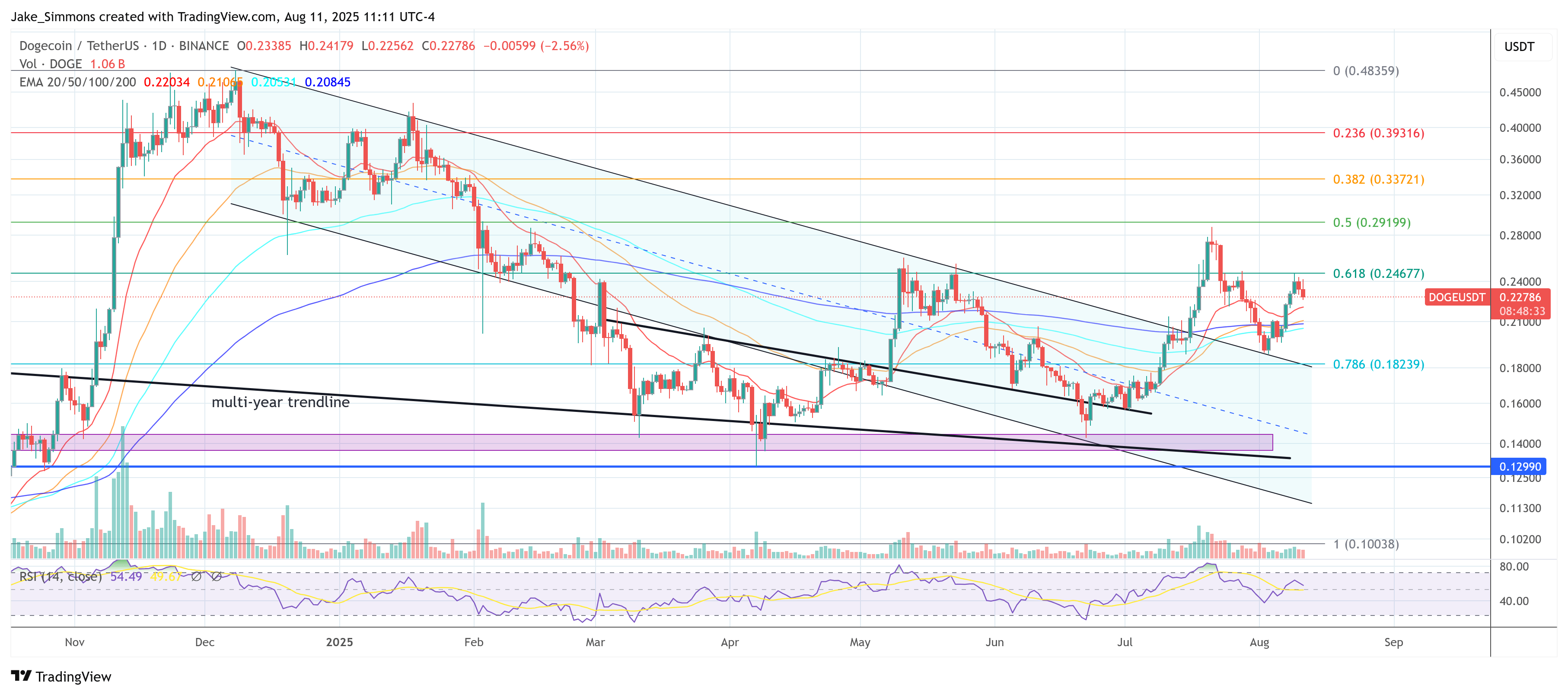

In his latest market update, the crypto analyst known as VisionPulsed tempers bullish hopes for Dogecoin, arguing that a move to the long-sought $1 mark will require a precise alignment of market forces that has yet to materialize. While acknowledging speculative bursts are possible, he warned that the broader setup remains incomplete, keeping the meme coin’s parabolic breakout on hold.

How Can Dogecoin Reach $1?

He laid out a data-driven case: unless Ethereum breaks decisively to new highs while the halving-cycle timing extension and global M2 liquidity backdrop stay supportive, Dogecoin’s next parabolic leg remains out of reach. The immediate backdrop, he notes, is a bounce in Bitcoin dominance that again sidelined the prospect of a broad altcoin rally.

Ethereum has improved the setup by making a new cycle high and clearing the $4,000 zone, but it now sits wedged beneath the final two technical hurdles from 2021—“the 2021 high in May and the 2021 high, which is the all-time high.” He frames the sequence plainly: “Once ETH breaks this high, ETH has officially gone onto a bull market.” Until that confirmation arrives, he treats talk of an imminent “Doge to the moon” phase as premature.

Related Reading

Price action on Dogecoin itself has not helped the cause. Vision Pulsed highlights a conspicuous topping-tail candle that formed after traders “piled in,” calling it “definitely not the candle you want to see.” He points to a prior instance where a similar wick preceded a local reversal, using it to caution against extrapolating short squeezes into sustainable trend.

In his read, Dogecoin remains in a broad, choppy accumulation—an area he sketches as a bottoming process that can include fakeouts on both sides—rather than a confirmed uptrend. Even in a constructive scenario, he warns that failure of the broader conditions could force “one more” downside sweep before any genuine altseason takes hold.

Timing is a second pillar of his analysis. He flags the 486-day mark from the most recent Bitcoin halving as a recurring inflection in prior cycles. “We are fastly approaching what would be considered the final bull-run push in 2021… 486 days from the halving,” he says, recalling that both of the last two cycles saw a sizable correction and then a final rally around that window.

With April 19, 2024 as the halving date, August 18, 2025 is the analogous threshold this time—a date he treats as context, not destiny. “There are no guarantees,” he stresses, reflecting on the limits of historical rhyme.

Related Reading

Liquidity—through the lens of the popular M2 money supply overlay—remains supportive, but not determinative in his view. He acknowledges that “everyone and their mother” watches M2 and that it currently “says there is a chance for a rally in this time period.” Yet he underscores that the relationship is not perpetual: in past cycles, M2 continued higher even as crypto rolled into a bear market. The takeaway is pragmatic and non-dogmatic: “We’ll use it until it doesn’t work,” but it cannot be a guarantee of an extended bull run on its own.

From this macro-and-liquidity scaffold, he distills a clear gating function for Dogecoin’s headline target. For a sustained advance toward one dollar, three conditions should align: Ethereum must break above its 2021 highs to confirm a fresh bull market; the halving-cycle “extension” window—centered on the ~486-day post-halving rhythm—needs to open the historical runway for a terminal rally; and global M2 expansion needs to stay supportive enough to keep risk appetite.

Inside Dogecoin’s own tape, he allows for meaningful volatility without structural change. “Could we have bullish swings back and forth to 30 cents? Sure,” he says, framing such moves as tradable ranges within a larger consolidation rather than the start of the terminal advance. What would convert that range into trend is not a single candlestick or an isolated breakout, but the multi-asset alignment he repeats throughout the update.

At press time, DOGE traded at $0.22.

Featured image created with DALL.E, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/dogecoin-2/dogecoin-to-1-only-if-this-plays-out-says-analyst/

2025-08-12 00:00:00