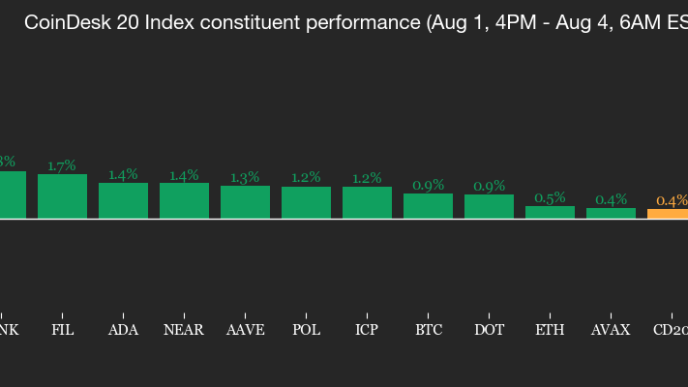

Conflux’s CFX emerged as the winner during weekend trading, gaining around 14%, according to CoinDesk market data, and surpassing the broader CoinDesk 20 index, which rose by 4%.

However, behind the scenes, there’s something missing: an uptick in on-chain activity. Conflux has positioned itself as being China’s Ethereum, with a regulatory-compliant digital ledger, that doesn’t have a token, available within mainland China.

Analysts speaking to CoinDesk in the past have called it a “one country, two systems” protocol, with its ability to straddle both the global crypto markets with a token and act as a digital ledger within mainland China, partnering with domestic web giants like China’s version of Instagram.

Given that insiders say that Beijing is warming to the idea of stablecoins to counter U.S. dollar hegemony, and Conflux is prepping an offshore-yuan stablecoin, the market euphoria is certainly justified. In the last 30 days, CFX is up over 190%.

All of this isn’t really reflected on-chain.

Aside from occasional spikes, transaction activity hasn’t grown in the last year, per data from network block explorers.

In fact, it’s still down from 2022 daily averages.

Other on-chain data shows that nearly 80% of the total gas spent in the protocol comes from three accounts, creating a concerning level of centralization.

In contrast, with Ethereum, the largest gas spender accounts for less than 10% of total gas spent on the network.

There certainly is a growing China narrative at the moment. Any sort of rumor that mainland China has banned crypto outright is demonstrably false. Hong Kong’s embrace of crypto mirrors how equity markets in Shanghai learned from their counterparts in the city before opening mainland China’s stock markets in the 1990s.

However, the question remains: Is Conflux the best proxy for this narrative? On-chain data would suggest otherwise.

Source link

Sam Reynolds

https://www.coindesk.com/markets/2025/08/04/conflux-s-cfx-rallies-on-china-buzz-but-fundamentals-lag-behind

2025-08-04 04:47:26