BNB Chain is making waves in the first half 2025 with impressive metrics like daily revenue, DEX trading volume, and block processing speed.

However, these achievements seem insufficient to spark a surge in BNB’s price.

BNB Chain’s Performance

The cryptocurrency market is witnessing a remarkable phenomenon in mid-2025 with BNB Chain. The explosive revenue is clear evidence of the network’s appeal. It reached its highest level since 2021, with significant peaks in January and late June 2025.

This growth may reflect more users, new projects, and increased activity across the network. However, as noted by CZ, this result could also stem from the network’s low-fee strategy.

According to X user TCC, despite BNB Chain’s extremely low or zero fees, it still ranks 5th in fees collected among all Layer-1 and Layer-2 networks.

This is due to its massive transaction volume, which drives significant revenue despite low per-transaction costs, thanks to the highest volume among all chains. According to user Ucan, monthly DEX trading volume on BNB Chain hit an ATH of over $157 billion in June, reflecting the vibrancy of its DeFi ecosystem and decentralized applications, helping the network maintain its lead in trading compared to other chains.

Maxwell Hardfork Upgrade

Another significant milestone is the successful implementation of the Maxwell Hardfork upgrade in late June, reducing block time from 1.5 seconds to 0.75 seconds. This sub-second processing speed enhances user experience and allows developers to build high-performance applications.

Compared to chains like Solana (0.4 seconds) or Ethereum (12-15 seconds), BNB Chain has balanced speed and cost, strengthening its competitive position.

“With new design possibilities for developers and improved infrastructure for validators ➜ expect more qualified dApps ➜ and more users to come.” X user andrew.moh shared.

BNB Price Still 17% Below ATH

However, the disconnect between revenue and BNB’s price remains a big question. According to CoinGecko, BNB’s price is currently 17% below its ATH, a paradox given the network’s “record-breaking” milestones, particularly in June.

This could stem from cautious market sentiment following previous bearish cycles and broader market developments amid recent tariffs and geopolitical instability. Additionally, competition from Layer-2 chains like Arbitrum may divert attention from BNB.

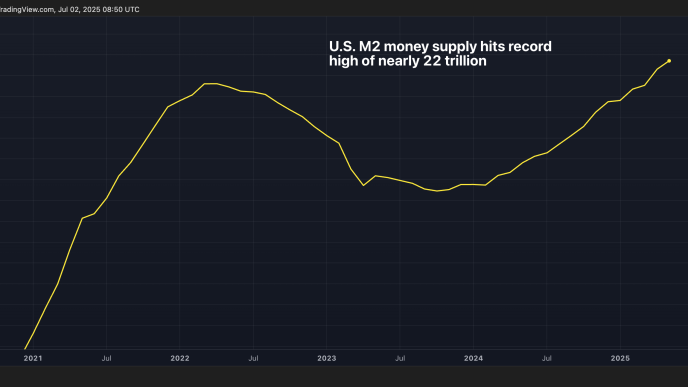

Looking ahead, BNB Chain has significant potential to overcome this challenge. With high transaction volume and superior processing speed, the network could attract more users and developers, especially if global liquidity continues to rise. Furthermore, some companies consider accumulating BNB, which could contribute to price momentum.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Linh Bùi

https://beincrypto.com/bnb-chain-booms-token-under-pressure/

2025-07-02 08:55:49