Following another rejection at the $120,000 level, Bitcoin (BTC) is beginning to show signs of cooling off – potentially setting the stage for another rally in the second half of the year. Some analysts now predict that BTC’s next top could approach $150,000.

Bitcoin’s Current Overheating Phase Short-Lived

According to a CryptoQuant Quicktake post by contributor Crypto Dan, Bitcoin is currently entering a cooling-off period after a short-term overheating phase. The warning signs are most evident in the cohort of BTC held for one day to one week.

Related Reading

Crypto Dan shared the following chart showing that this short-term holding cohort is now recording successively lower spikes, suggesting that overheated market conditions are easing.

The analyst compared the current environment to previous overheating phases seen between March-October 2024 and January-April 2025. In both instances, the overheating lasted longer and was more intense (shown in red boxes).

In contrast, the current overheating conditions (shown in yellow box) show shorter extent and duration compared to the aforementioned two instances. The analyst added:

Also, since the recent price increase was relatively modest, we may see a milder and shorter correction in the short term. However, it’s important to remain patient and look forward to a potential uptrend in the second half of 2025.

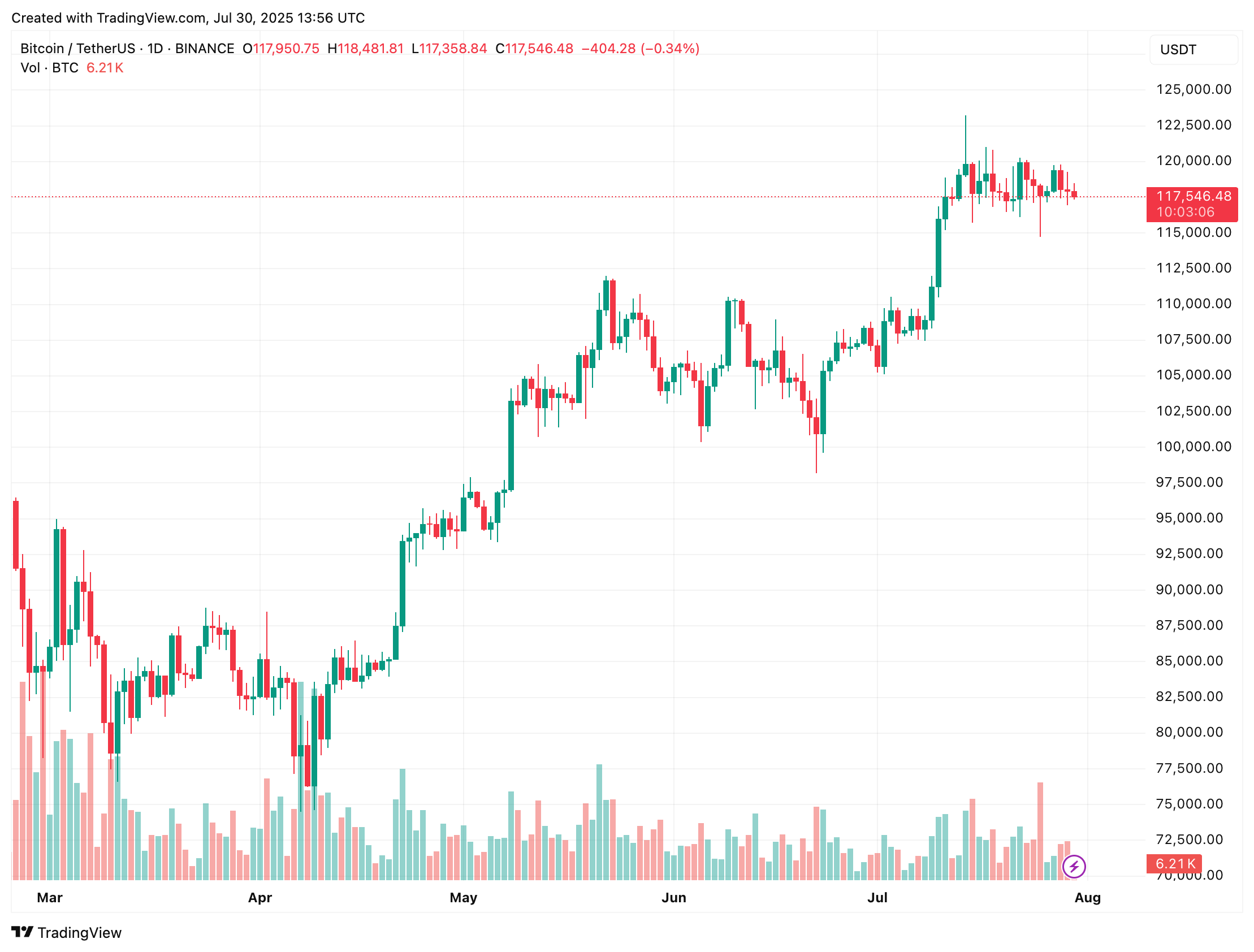

The increase in BTC’s price during the latest rally saw the digital asset surge from around $108,000 on July 1 to a new all-time high (ATH) of $123,128 on July 13, before stabilizing around the $117,500 mark at the time of writing.

Is BTC Preparing For Its Next Big Move?

As Bitcoin consolidates, several analysts suggest the top cryptocurrency may be gearing up for a major move – likely to the upside. Veteran crypto analyst Titan of Crypto noted that Bitcoin is currently “in a pressure cooker.”

Related Reading

Titan of Crypto shared the following chart, highlighting that Bollinger Bands are tightening while volatility is shrinking. At the same time, the Relative Strength Index (RSI) is compressing – often a precursor to a breakout.

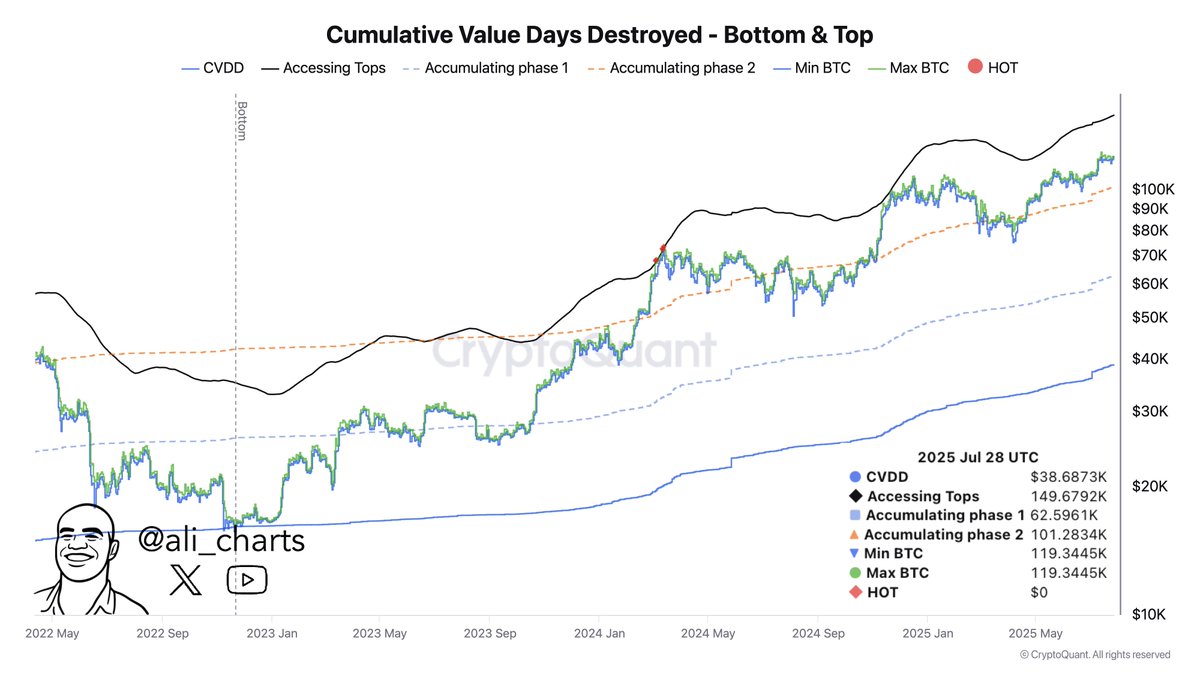

Fellow analyst Ali Martinez added that BTC’s next top could reach $149,679, based on the Cumulative Value Days Destroyed (CVD) metric. For context, the CVD metric measures whether buyers or sellers are dominating trading volume over time.

That said, some warning signs linger. Recently, Bitcoin exchange reserves reached a one-month high, suggesting that some holders may be preparing to sell – potentially putting pressure on the current bullish trend. At press time, BTC trades at $117,546, down 0.4% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant, X, and TradingView.com

Source link

Ash Tiwari

https://www.newsbtc.com/bitcoin-news/bitcoin-overheating-signals-second-half-rally/

2025-07-31 02:00:38