Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

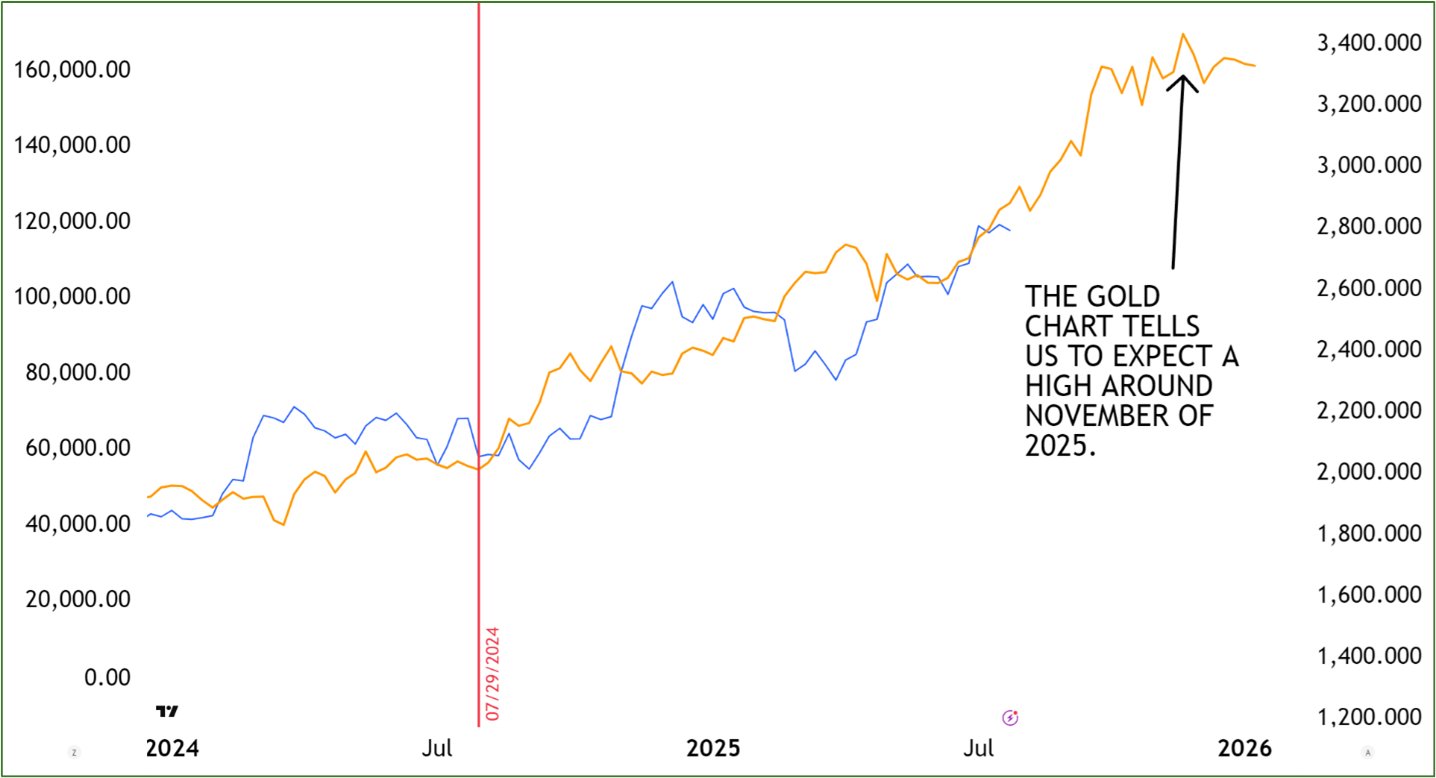

A thread posted late on 4 August 2025 by Weiss Crypto analyst Juan Villaverde has ignited debate about a rarely discussed harbinger of Bitcoin price cycles. In a thread on X, the quantitative researcher argued that an “overlooked asset class”—one he says almost no-one monitors in a crypto context—consistently pivots months before Bitcoin does, offering what he calls “a sneak peek at major turning points.” Villaverde’s proprietary back-testing suggests the lag is approximately six months, enough lead time, he claims, to anticipate the apex of the current bull market in late November.

How Gold’s Trendlines Map The Bitcoin Price

“Many are aware that Bitcoin tends to follow global liquidity—with a roughly twelve-week lag,” Weiss Crypto wrote, setting the stage for the reveal. “But Juan Villaverde has quietly tracked a different early indicator… one that can signal where BTC is headed six months in advance.” In a follow-up post he teased, “That little-known indicator? [ … ]. Turns out, its price action often leads Bitcoin by several months—providing a sneak peek at major turning points.”

Related Reading

Villaverde’s thesis rests on a data series stretching back to the advent of modern crypto markets. He points to the trough of December 2018, which, in his reconstruction, was foreshadowed by a significant low in the mystery market some weeks earlier. “After analysing years of data, Juan spotted a consistent pattern,” Weiss Crypto stated, quoting the analyst to the effect that “major lows [there] tend to precede major lows in Bitcoin.”

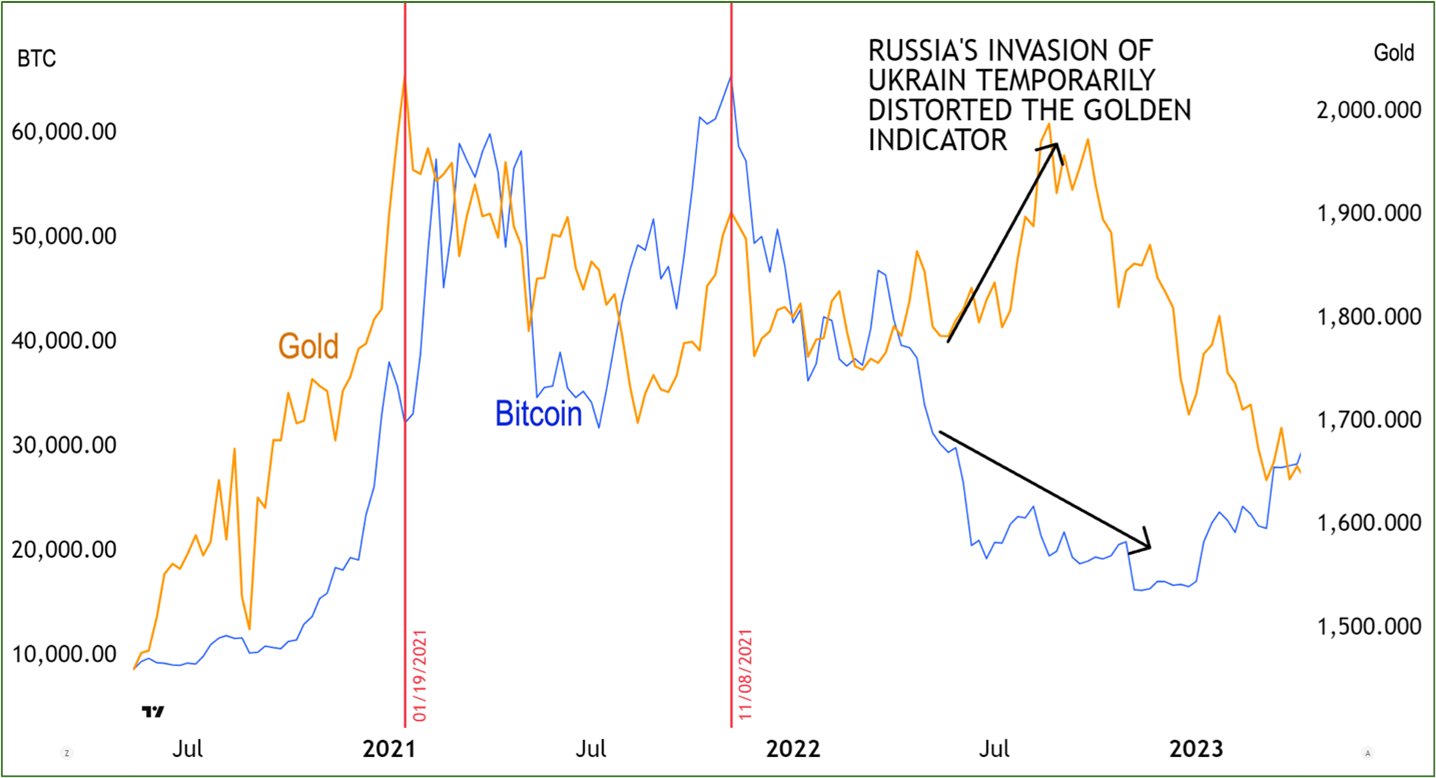

The same lead-lag cadence, Villaverde notes, flashed red in November 2021 when Bitcoin printed its all-time high even as the benchmark asset he tracks refused to break higher—an omen that presaged the 2022 bear market.

The model is not without blemishes. Weiss Crypto acknowledged “one exception in recent years—during the Russia–Ukraine invasion—where the Bitcoin relationship temporarily inverted due to macro chaos.” Yet Villaverde maintains the anomaly reinforces rather than weakens his conviction: exogenous geopolitical shocks can distort correlations, but once the shock dissipates the historic rhythm reasserts itself.

Related Reading

Where does that leave the market in mid-2025? “According to Juan’s analysis,” the firm wrote, “the indicator is pointing to a major high in Bitcoin around late November 2025. That aligns perfectly with his Crypto Timing Model.” Villaverde cautions that the signal is dynamic, not deterministic. If the benchmark asset he watches “rallies above its April high,” it would imply “Bitcoin could march higher into 2026.” Conversely, any decisive breakdown would “be an early warning that crypto’s bull market may be nearing its end after November.”

Villaverde insists the relationship he has identified is robust because it focuses on magnitude rather than direction alone. “It’s not only the turns that matter,” he said in a direct message to this outlet, “but the amplitude of those turns.” By quantifying both, he argues, the signal captures investor psychology cycling from fear to greed and back again.

At press time, BTC traded at $114,522.

Featured image created with DALL.E, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/bitcoin-news/bitcoin-is-secretly-tracking-this-market-signal/

2025-08-05 14:00:00