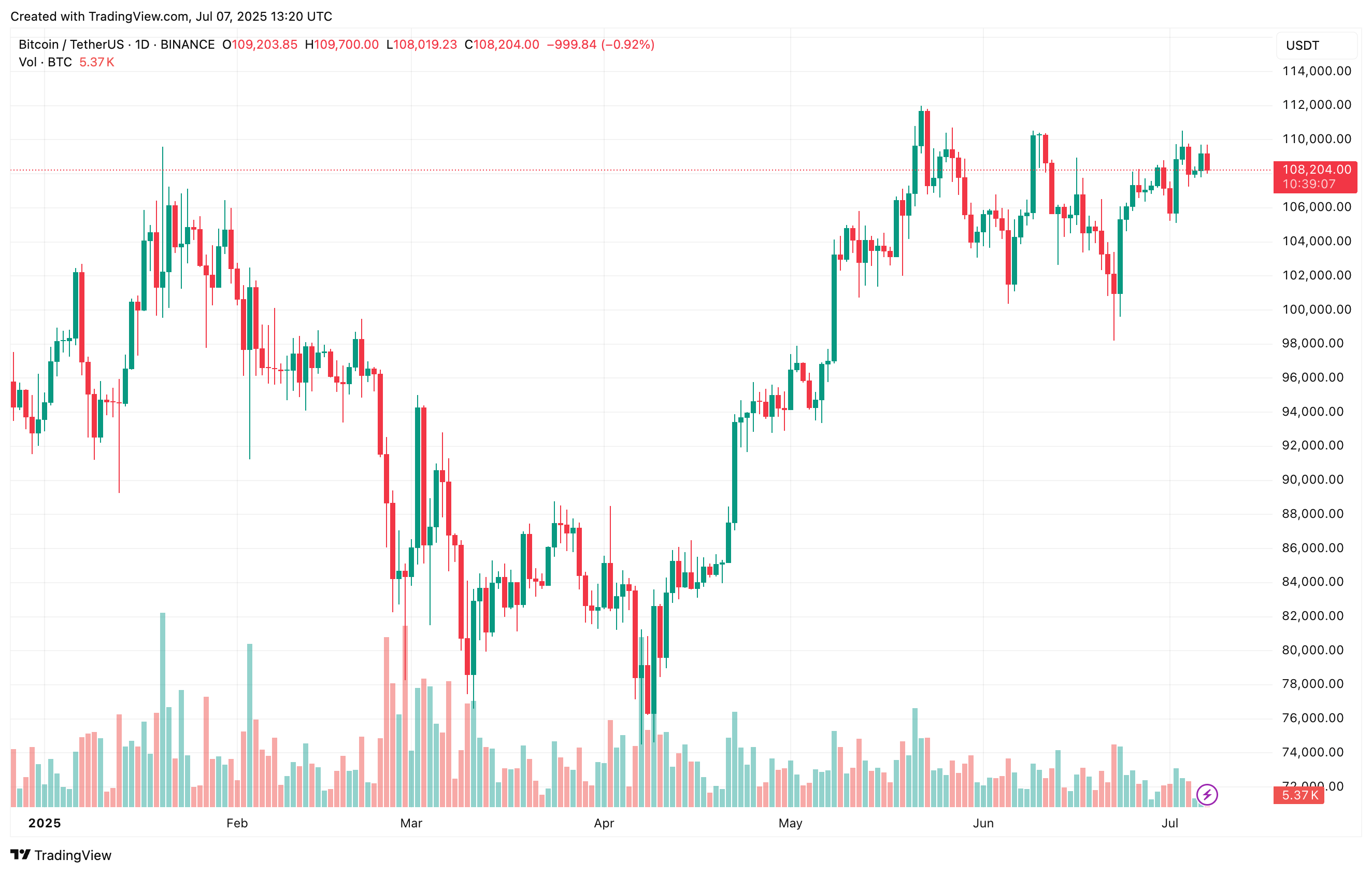

Bitcoin (BTC) is up 7% over the last two weeks, showing signs of strength despite expectations that the US Federal Reserve (Fed) will keep interest rates unchanged at its upcoming July 30 meeting. However, some indicators suggest that the market may be entering overheating territory.

Bitcoin Market Entering Overheating Territory?

According to a recent CryptoQuant Quicktake post by contributor burakkesmeci, the Bitcoin Network Value to Transaction (NVT) Golden Cross is on the rise. Importantly, this upward movement is beginning to signal signs of market overheating.

Related Reading

For the uninitiated, the Bitcoin NVT Golden Cross is a technical indicator that compares short-term and long-term moving averages of the NVT ratio to identify potential market tops or bottoms. When the short-term NVT crosses above the long-term average, it often signals that Bitcoin is becoming overvalued and may face a short-term correction.

Notably, this indicator has successfully predicted three local tops so far in 2025. The first occurred on February 5, when the NVT Golden Cross hit 2.68 while BTC traded at $97,600, followed by a 23.65% correction.

On March 24, the indicator peaked at 2.87 with BTC around $87,500, leading to a subsequent correction of 16.06%. Most recently – on June 16 – it rose to 2.21 with BTC trading at $106,800, which was followed by a 9.87% price dip.

Currently, the NVT Golden Cross stands at 1.98. Although it hasn’t crossed the key 2.2 threshold yet, its upward trajectory suggests that market overheating could be brewing. The CryptoQuant analyst explained:

Breaking its previous high is moderately bullish and shows momentum is building. If the metric crosses 2.2 again, it may hint at a local top. But don’t rush to exit – historically, the metric has stayed above 2.2 for several days.

In conclusion, burakkesmeci noted that while crossing the 2.2 level might suggest Bitcoin is heating up in the short-term, it could also signal a return of bullish momentum in the medium-term. That said, the opinion on BTC’s short-term price trajectory is largely divided.

Analysts Split Over BTC Price Action

The NVT Golden Cross suggests that BTC may still have room to rally before hitting a potential local top. However, some analysts foresee a short-term pullback before Bitcoin reaches new highs.

Related Reading

For instance, noted crypto analyst Chistian Chifoi described the current BTC price action as a “deceptive setup,” warning it may trap bulls before a possible surge toward a new all-time high (ATH) of $160,000.

Meanwhile, on-chain analytics firm Glassnode forecasts BTC’s short-term peak at $117,000. At press time, BTC trades at $108,204, down 0.1% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com

Source link

Ash Tiwari

https://www.newsbtc.com/bitcoin-news/bitcoin-heating-up-nvt-golden-cross-hints-at-potential-local-top/

2025-07-07 23:30:27