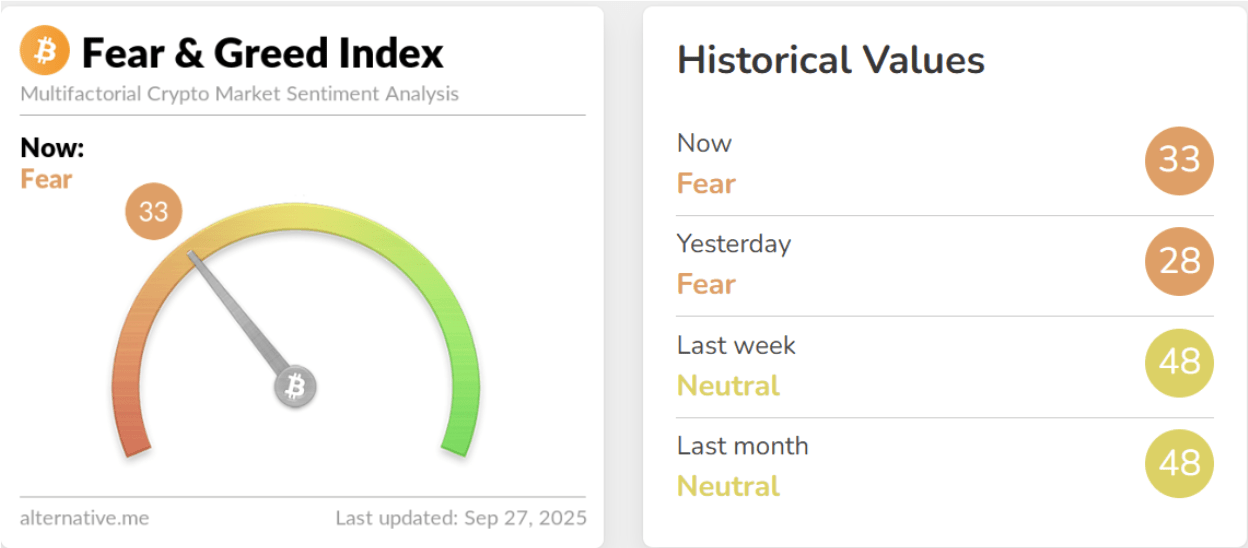

The cryptocurrency market is in a tense mood after Bitcoin lost important price levels this week, and investor sentiment has taken a beating. This caused the Bitcoin Fear & Greed Index to plunge by 16 points in a single day, sinking to 28 yesterday, its lowest level since March. At the time of writing, the index has recovered slightly to 33, but it still in the Fear zone. This may unsettle many investors, but history shows that fearful conditions may be blessings in disguise for Bitcoin investors.

Related Reading

Bitcoin Fear & Greed Index Drops To 28

This week has been tough for many cryptocurrencies, especially Bitcoin. Bitcoin, which started the week above $115,000, entered into an extended decline that saw it break below $110,000, which in turn led to liquidations of over $1 billion worth of positions across the industry. This move also saw Ethereum break below $4,000, alongside altcoins likes XRP, Solana extending to the downside.

Taken together, these moves erased the cautious optimism of last week, when the index sat at a neutral level of 48. Instead, Bitcoin’s Fear and Greed Index fell to as low as 28, which is a dramatic 16 point plunge in a single day.

This crash in the Bitcoin Fear and Greed Index shows just how fast sentiment can reverse when important price thresholds fail to hold. However, while the fearful mood might appear to be a bearish hint, these conditions could be an opportunity for long-term traders. The Fear and Greed Index has historically been a contrarian indicator, with extreme fear levels typically appearing before significant rebounds.

Earlier in March, when the index last reached similar depths, Bitcoin was trading at a relative low around $83,000. Today, even after breaking below 30 on the index again, Bitcoin is about $27,000 higher than it was in March.

Bitcoin Fear And Greed Index. Source: Alternative.me

Constructive Outlook For The Coming Weeks

The broader takeaway from this sentiment shift is that the crypto market may be closer to its next recovery phase than many expect. The index’s slight rebound to 33 today from yesterday’s low of 28 shows that some traders are already positioning for a turnaround. For one, Bitcoin’s current prices could give savvy investors the chance to accumulate Bitcoin at discount prices.

Bitcoin rarely sustains rallies in conditions of overwhelming greed. Instead, consolidations and corrections reset sentiment and make room for healthier growth. For instance, crypto analyst Michael Pizzino said in a post on X, that the most recent fear could be the turning point Bitcoin and crypto has been waiting for.

Related Reading

In this sense, the fearful environment may be setting the stage for Bitcoin, Ethereum, and other altcoins to build bullish momentum once selling pressure eases.

Now, the most important thing is for the Bitcoin price to reestablish itself above $110,000. At the time of writing, Bitcoin is trading at $109,220.

Featured image from Unsplash, chart from TradingView

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/bitcoin-fear-greed-index-crashes-to-lowest-level-since-march-why-this-is-good-news/

2025-09-28 00:00:00