Bitcoin has seen “buy the dip” mentions spike on social media after the price crash, but Santiment warns this could be a contrarian signal.

Social Media Users Are Calling To Buy The Bitcoin Dip

In a new Insight post, analytics firm Santiment has talked about how the market has been reacting to the latest plunge in the Bitcoin price. “One of the first things we like to look for is a sign of retailers showing enthusiasm toward buying the dip,” notes Santiment.

The indicator cited by the analytics firm is the “Social Volume,” which measures the total amount of posts/messages/threads appearing on the major social media platforms that make unique mentions of a given term or topic.

Santiment has filtered the Social Volume for Bitcoin-related keywords and terms pertaining to calls for “buy the dip.” Below is a chart showing the trend in the metric over the past month.

As is visible in the graph, the Bitcoin Social Volume has spiked for these terms, indicating that interest in buying the dip has surged among social media users. At the current value, dip-buying calls are at their highest in 25 days.

While this could sound like a signal that a rebound may be coming soon for the cryptocurrency, history has had many examples of the contrary. “Prices typically move the opposite direction of the crowd’s expectations,” explains the analytics firm. Considering this, the dip-buying hype could actually be a sign that more pain may be ahead for BTC before the bottom can actually be in.

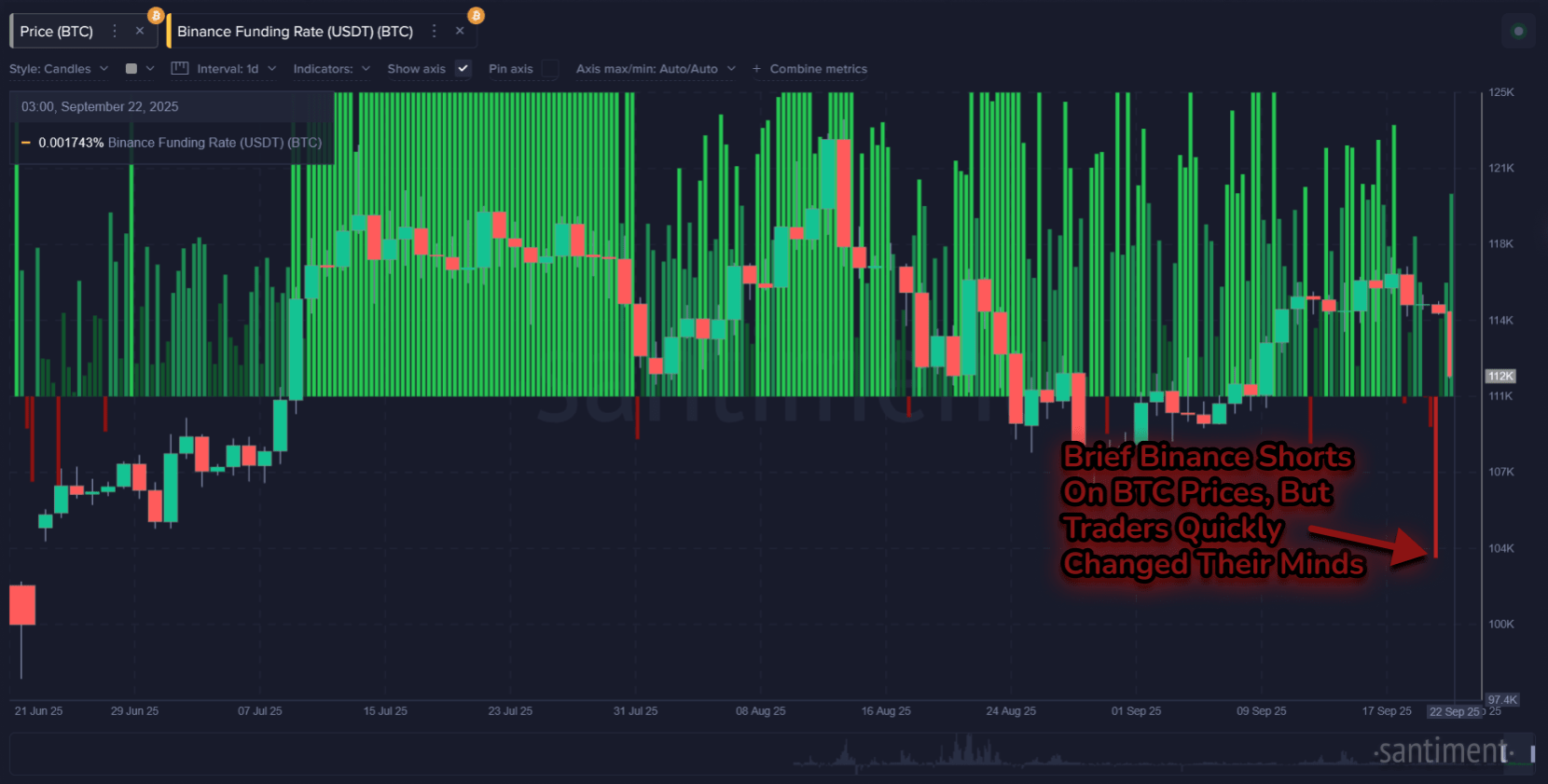

“Once the crowd stops feeling optimistic, and they begin to sell their bags at a loss, this is typically the time to strike with your dip buys,” says Santiment. Another gauge for market sentiment is through the Binance Funding Rate, which is a metric that keeps track of the periodic fee that derivatives traders are exchanging between each other on the largest cryptocurrency exchange by trading volume.

The indicator turned sharp red just ahead of the latest plummet in the Bitcoin price, indicating that short positions became dominant on Binance. After the decline, however, traders changed their tune as the metric switched back to being green.

This trend would suggest that investors are hoping Bitcoin would rebound soon. “Ideally, for a notable price bounce to occur, we need to see a sustained period of shorts outpacing longs,” notes the analytics firm. As such, this could be another indicator to keep an eye on, as a flip into the negative for an extended phase may pave the way toward a bottom.

BTC Price

Bitcoin has been unable to make recovery from its crash so far as its price continues to trade around $112,700.

Source link

Keshav Verma

https://www.newsbtc.com/bitcoin-news/bitcoin-dip-buy-calls-spike-why-actually-bearish/

2025-09-24 03:00:00