Avalanche

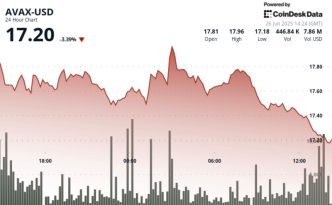

broke below critical $17.45 support level amid accelerated selling pressure, dropping 3.4% over 24 hours, according to CoinDesk Research’s technical analysis model.

The move underperformed CoinDesk 20 — an index of the top 20 cryptocurrencies by market capitalization, excluding stablecoins, memecoins and exchange coins — which has fallen 1.6% in the same period of time.

Technical Analysis

• AVAX experienced a significant downtrend over the last 24 hours, falling from $17.82 to $17.21, representing a 3.4% decline with a total range of $0.85 (4.76%).

• Price action formed a short-term “double top” pattern near $18.02, with the subsequent rejection leading to accelerated selling on above-average volume.

• Volume spiked to 710,723 units, indicating a potentially strong bearish conviction as key support at $17.45 was breached.

• AVAX dropped from $17.33 to a low of $17.02 (-1.79%) before staging a recovery to close at $17.25.

• A V-shaped pattern formed with intense selling pressure when volume spiked to 33,423 units as price broke below the $17.20 support level.

• Buyers stepped in, pushing AVAX back above the $17.20 level with increasing volume, suggesting potential short-term stabilization.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Source link

CD Analytics

https://www.coindesk.com/markets/2025/06/26/avax-underperforms-broader-crypto-market-as-short-term-double-top-pattern-emerges

2025-06-26 14:45:52