In a turbulent second quarter (Q2) for the cryptocurrency market, Avalanche (AVAX), a layer-1 blockchain platform frequently considered a competitor to Ethereum (ETH), reported a mixed bag of financial metrics.

Avalanche Price Declines But User Engagement Soars

A recent analysis from data firm Messari revealed that AVAX’s price fell 4.2% quarter-over-quarter, dropping from $18.77 to $17.99. This decline came alongside a 2.6% decrease in its circulating market cap, which fell from $7.8 billion to $7.6 billion.

The impact of this price drop was also reflected in AVAX’s market ranking, which fell from 15th to 16th among all cryptocurrencies. However, not all metrics were negative.

Transaction fees for AVAX surged by nearly 29% during the quarter, increasing from 58,300 to 75,170. In terms of revenue, transaction fees in USD also rose slightly, going from $1.50 million to $1.54 million, indicating a growing user base and increased activity on the platform.

Related Reading

A particularly bright spot for Avalanche in Q2 2025 was the significant growth in daily transactions across its C-Chain and other layer-1s. Average daily transactions skyrocketed by 169.91%, reaching 10.1 million compared to 3.7 million in the previous quarter.

This was complemented by a dramatic increase in daily active addresses, which surged by 210.45% to 519,954, suggesting a robust uptick in user engagement.

In line with this growth, Avalanche also reduced its average transaction fees by 42.7%, from $0.05 to $0.03. This reduction is largely attributed to the Octane upgrade, which introduced a dynamic fee mechanism on Avalanche’s C-Chain, allowing for real-time fee adjustments to enhance user experience and reduce costs.

C-Chain Transactions And DeFi TVL Soar

The C-Chain in particular saw impressive usage growth, with average daily transactions jumping 493.4% from 244,995 at the end of Q1 to 1.4 million by the end of Q2.

Daily active addresses also experienced a healthy increase of 57% quarter-over-quarter, rising from 29,554 to 46,397. Notably, there was a spike to 419,619 daily active addresses on May 11.

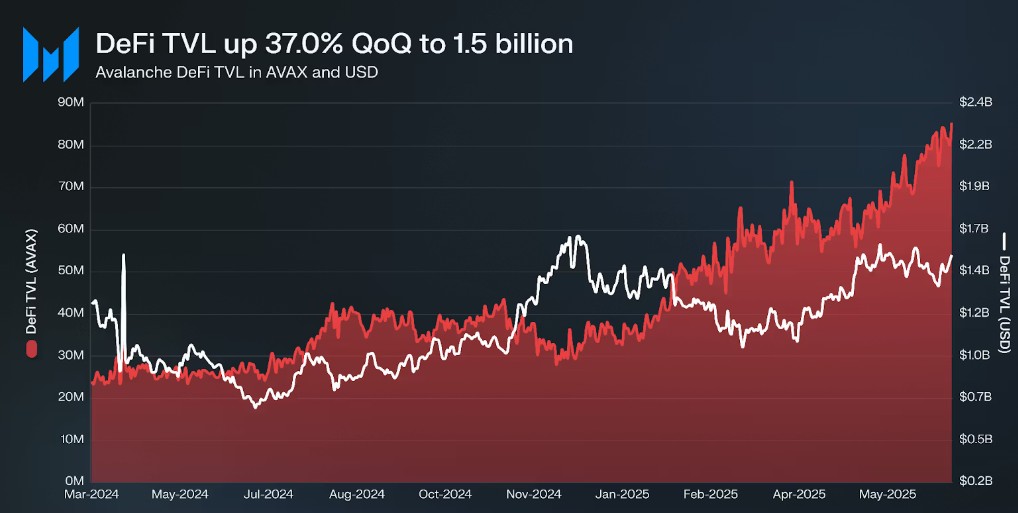

As seen in the chart above, Avalanche’s total value locked (TVL) in decentralized finance (DeFi) rose 37.1%, climbing from $1.1 billion to $1.5 billion. However, the stablecoin market cap on Avalanche saw a significant decline of 23.8%, dropping from $1.9 billion to $1.5 billion.

Related Reading

The rise in daily active addresses across Avalanche’s layer-1 platforms was particularly noteworthy. The average daily active addresses surged by 444.8% quarter-over-quarter, from 68,723 to 374,402.

As of this writing, AVAX’s price has recovered from Q2 lows toward the $23 zone, rising 35% in the past thirty days due to the recent bullish sentiment that led Bitcoin (BTC), the market’s leading crypto, to reach a new all-time high above $123,000.

Featured image from DALL-E, chart from TradingView.com

Source link

Ronaldo Marquez

https://www.newsbtc.com/news/avalanche/avalanche-avax-defi-tvl-rises-nearly-40-following-octane-upgrade/

2025-07-27 07:30:26