Chainlink (LINK) is attempting to reclaim a crucial area after recovering 10%, surpassing most of the market in the past day. Some analysts suggested that the altcoin is ready to break out to new highs, but warned that a rejection from the current levels could lead to volatile retests.

Related Reading

Chainlink Reclaims Key Levels

On Wednesday, Chainlink led the crypto market as it started to recover from the recent pullback, which saw most cryptocurrencies retest their range lows for the first time in two weeks.

LINK recorded the second-best performance among the top 100 cryptocurrencies, with an 11% increase in the past day. Notably, the altcoin hit a six-month high of $26.76 on Monday, after recovering 14% from the weekend lows.

As it hit its multi-month high, analyst Ali Martinez pointed out that Chainlink added nearly 3,000 new addresses. According to the post, 2,995 new LINK addresses were created on August 18, the highest growth in 5 months.

However, the start-of-week correction halted the bullish momentum, sending the cryptocurrency’s price to retest its breakout zone, around the $23.50 mark on Tuesday. After testing this area as support, Chainlink rebounded and reclaimed the $24.50-$25 range, briefly hitting the $26.50 barrier on Wednesday morning before retracing.

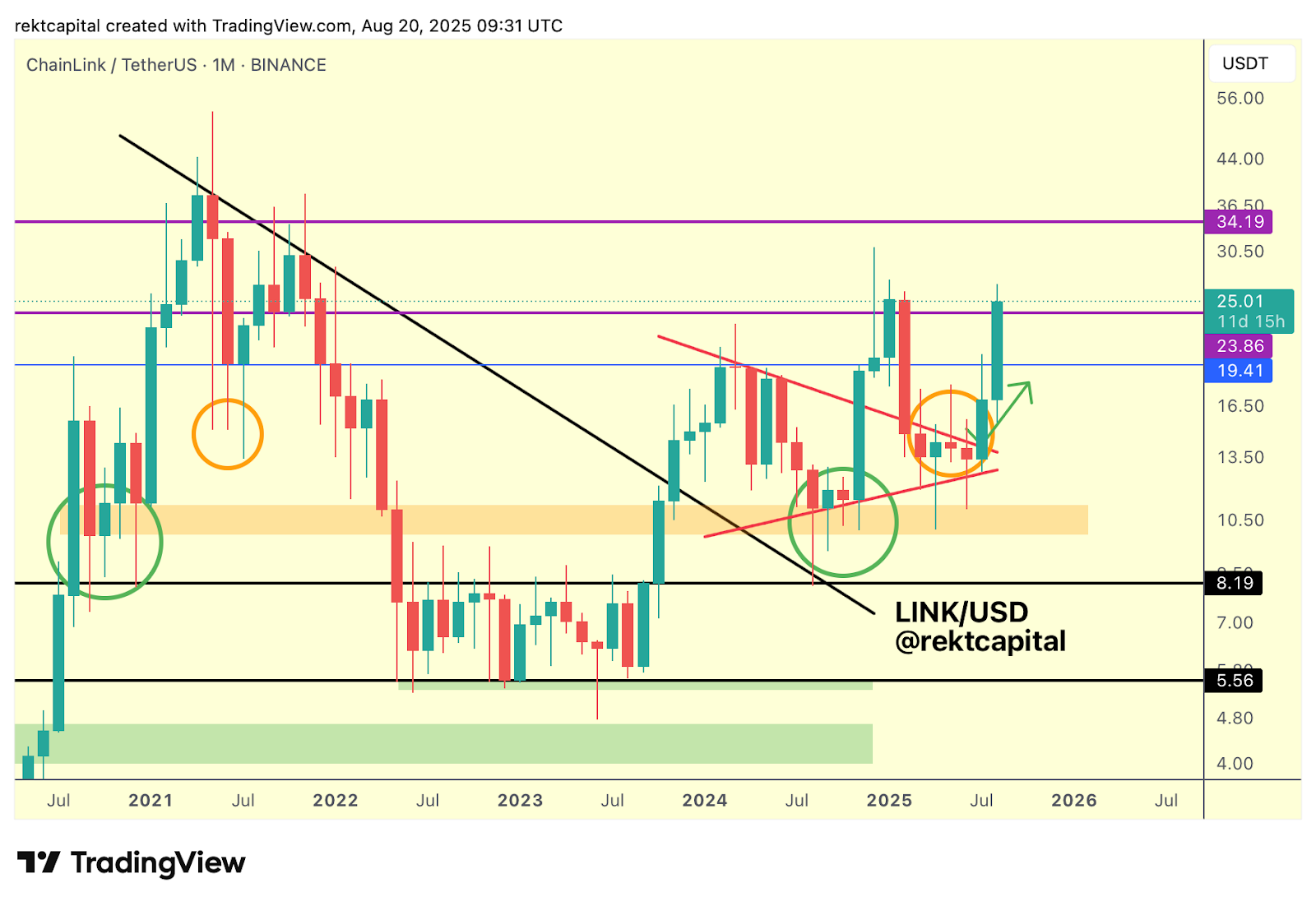

Analyst Rekt Capital asserted that LINK is attempting to reclaim the $23.86-$34 price area after the recent performance. He highlighted that the lows of this range have historically been a “key support and successful retests here have enabled rallies to the Range High around $34.”

Chainlink’s continued stability at the $23.86 level will be crucial for the rally to the range high. The market watcher noted that volatility below this range is possible as part of a volatile retesting process.

LINK’s Levels To Watch

The cryptocurrency’s monthly close is one of the most important levels to watch, as closing above the range low would position Chainlink for a bullish rally continuation. On the contrary, failing to reclaim this area in the monthly timeframe could lead to a deeper pullback toward the $19.41 level, not seen since the early August breakout.

Rekt Capital explained that this level “has often acted as a volatile retest zone in bullish cycles, serving as a base for successful reversals, most prominently in mid-2021,” concluding that the cryptocurrency’s next move will be determined by a reclaim of the $23.86 resistance or a volatile retest of the $19.41 support.

Altcoin Sherpa suggested that Chainlink will continue its path to the $30 barrier if the flagship cryptocurrency continues its uptrend. He affirmed that if Bitcoin loses the $110,000 support, LINK will likely see another dip.

Related Reading

However, if BTC’s price stabilizes, the analyst considers that the altcoin could soar to the crucial resistance. Meanwhile, market watcher CW asserted that Chainlink faces one more key area before rallying to $30.

According to the post, if LINK breaks through the current sell wall, around the $26.25-$26.75 levels, it will continue its run toward the $30 resistance, where another selling wall is situated.

As of this writing, Chainlink trades at $26.15, a 35% increase in the monthly timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com

Source link

Rubmar Garcia

https://www.newsbtc.com/news/chainlink-eyes-crucial-resistance-after-25-reclaim/

2025-08-21 08:00:00