In brief

- Verb Technology said that it is rebranding to TON Strategy

- The firm will accumulate Toncoin using proceeds from a private placement.

- The company’s stock price soared 140% on Monday.

Verb Technology will use $558 million in proceeds from a private placement to begin stockpiling and staking Toncoin, the Las-Vegas based marketer said in a press release on Monday.

The cryptocurrency, which serves as the native token of the Telegram-linked The Open Network, will be treated as the company’s “primary treasury reserve asset,” it said—representing the latest twist on a growing list of crypto treasury firms dedicated to various digital assets.

The company’s private placement in public enquiry, or PIPE, was upsized, with investors purchasing 59 million common shares at $9.51, Verb Technology said. The Nasdaq-listed company’s stock soared 140% to $22.68 on Monday, according to Yahoo Finance.

Toncoin is officially separate from Telegram, but the network was conceived by brothers Nikolai and Pavel Durov, who also created the popular messaging app.

Telegram backed away from The Open Network years ago following regulatory scrutiny, but it was later picked up by a community of open-source developers. The Open Network gained newfound attention after TON wallets were added to Telegram in 2023, and late last month, The Open Network and Telegram unveiled an “exclusivity deal.”

Under the deal, Telegram mini apps, such as games, will be required to use TON, including once-popular tap-to-earn titles like Hamster Kombat and Notcoin.

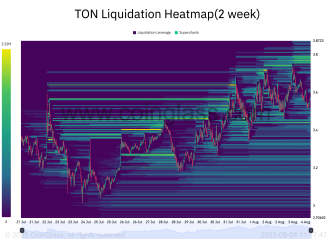

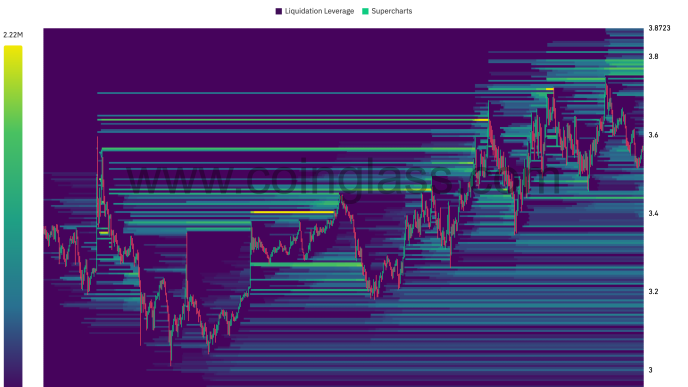

Despite Monday’s announcement, Toncoin fell 6.9% to $3.41, according to crypto data provider CoinGecko. Still, the cryptocurrency’s price has increased 24% over the past month.

Crypto treasury companies have raised billions of dollars to accumulate major cryptocurrencies like Bitcoin and Ethereum, but Toncoin is relatively unknown. Across all tokens tracked by CoinGecko, it’s the 27th largest by market cap at $8.2 billion.

Verb Technology said on Monday it is rebranding to TON Strategy, and its PIPE is expected to close on Thursday. When the U.S. Securities and Exchange Commission has deemed registration-of-shares filings effective in the past, shares of some crypto treasury firms that used PIPEs to raise funds have plummeted alongside insider profit-taking.

When the transaction is closed, Verb Technology will undergo some leadership changes, it said. Manuel Stotz, founder and CEO of investment firm Kingsway Capital, is the president of the TON Foundation, who will become the Verb Technology’s executive chairman.

“Telegram is the preferred messenger for the growing global crypto community and $TON is the currency that powers the Telegram ecosystem,” he said in a statement, arguing the token “not only has the potential to compound in value, but also offers staking yield.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

André Beganski

https://decrypt.co/333469/a-ton-strategy-telegram-linked-online-marketer-to-raise-558-million-for-treasury

2025-08-04 21:22:00