Ethereum is showing renewed strength after a sharp but short-lived pullback. Following its recent high of $3,860, ETH dipped to the $3,500 zone — a key level that quickly attracted buying interest. Now, price action is pointing upward again, with Ethereum pushing to reclaim the $3,700 range, signaling bullish momentum may be back in control.

Related Reading

Despite the recent volatility, on-chain data support the case for continued upside. According to Santiment, whales have been aggressively accumulating ETH throughout the pullback. This surge in accumulation suggests that institutional players are positioning themselves ahead of the next leg of the rally, anticipating strength in the coming months. These strategic inflows have historically preceded sustained upward trends.

The resilience around the $3,500 level, combined with the swift recovery attempt, underscores Ethereum’s strong bullish structure. With a favorable macro environment, regulatory clarity, and mounting institutional interest, Ethereum appears poised for continued expansion as the second half of the year unfolds. All eyes are now on whether this bounce holds and leads to a renewed breakout above resistance.

Whales Add Ethereum as US Legal Clarity Boosts Bullish Outlook

Ethereum’s bullish momentum is being reinforced by aggressive accumulation from major investors. According to analyst Ali Martinez, whales have purchased more than 1.13 million ETH—worth approximately $4.18 billion—over the past two weeks. This surge in buying activity marks one of the most significant accumulation phases in recent months and signals rising confidence among institutional players.

The accumulation comes at a critical time for Ethereum, which has been consolidating near the $3,700 level after a brief pullback from its $3,860 high. This whale activity not only adds fuel to the ongoing price recovery but also strengthens Ethereum’s bullish structure heading into the second half of the year.

Beyond market behavior, macro and regulatory shifts are also favoring Ethereum and the broader altcoin market. The recent passage of the GENIUS Act and Clarity Act by the US Congress marks a pivotal moment for crypto legislation. These new laws offer long-sought legal clarity for decentralized finance (DeFi) platforms and digital assets, encouraging US-based innovation and capital flows into the space.

This evolving regulatory framework removes one of the biggest barriers for institutional adoption of Ethereum and DeFi. With clearer rules and a growing appetite for ETH among whales, the stage is set for a potentially explosive rally if current momentum holds.

Related Reading

ETH Holds Strong After Pullback

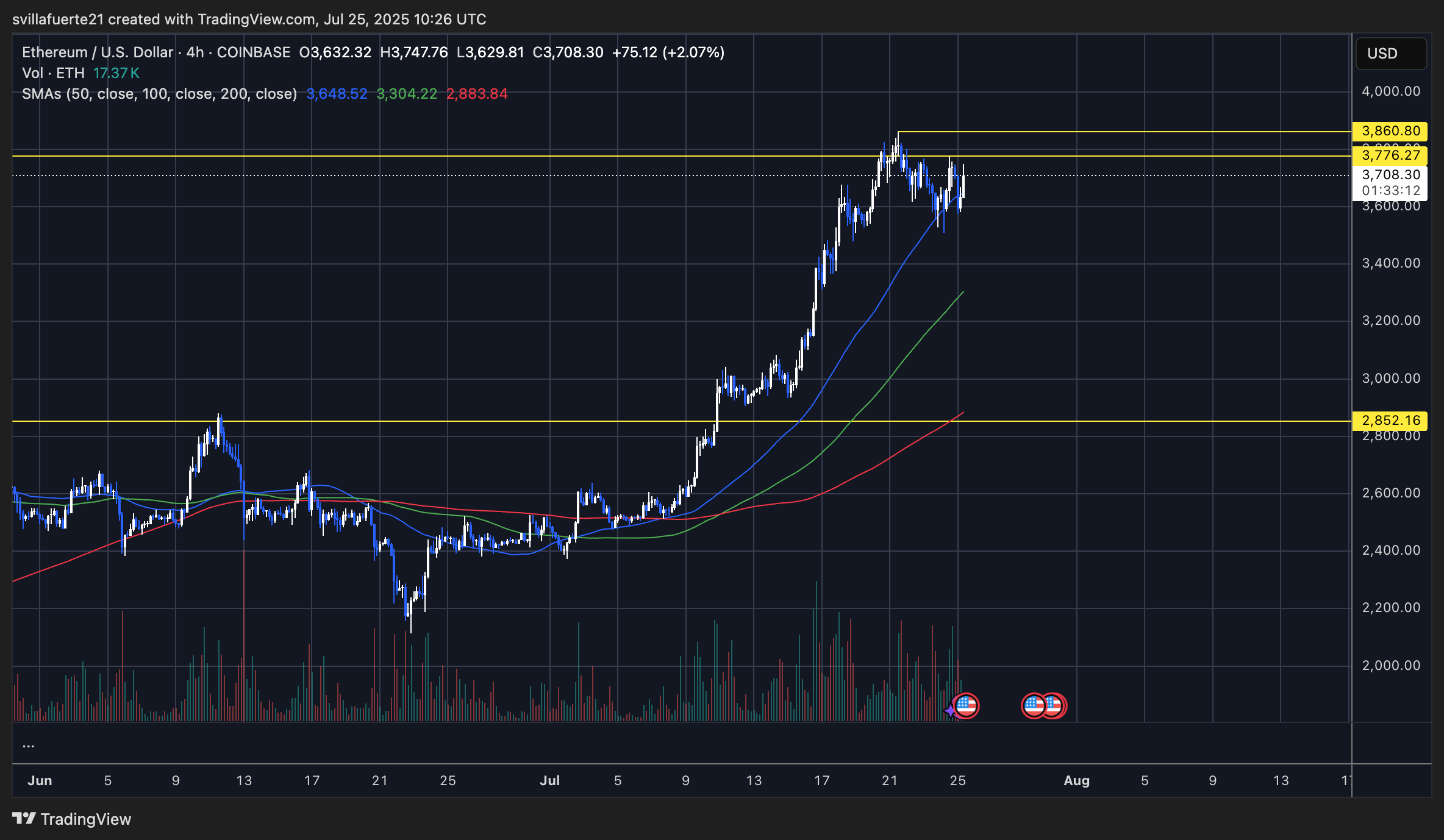

Ethereum (ETH) is showing renewed strength after a brief correction from its local top at $3,860. As seen in the 4-hour chart, ETH dipped to $3,500 but quickly bounced, reclaiming the $3,700 zone and closing in on key resistance at $3,776 and $3,860. This rebound indicates strong buyer interest and resilience in the uptrend.

The price is now trading above all major moving averages (50, 100, and 200), which are stacked bullishly. The 50-SMA at $3,648 has provided dynamic support in recent sessions, while the 100-SMA and 200-SMA at $3,304 and $2,883, respectively, remain far below current price action—underscoring the strength of this upward move.

Related Reading

Volume is picking up slightly as ETH consolidates in a tight range near resistance. A breakout above $3,860 would likely open the door to a move toward new local highs, while failure to breach this level may result in another test of the $3,648 support area.

Featured image from Dall-E, chart from TradingView

Source link

Sebastian Villafuerte

https://www.newsbtc.com/news/ethereum/ethereum-whales-accumulate-over-4-1b-in-eth-in-two-weeks-details/

2025-07-25 10:33:36