Bitcoin (BTC) may be on the cusp of another rally, as leading cryptocurrency exchange Binance saw its spot volume rise from around 40% on July 15 to as high as 60% on July 18. Historical data suggests that surges in Binance’s spot market share have frequently preceded upward movements in BTC’s price.

Bitcoin Rally Imminent? Binance Data Suggests So

According to a CryptoQuant Quicktake post by contributor Amr Taha, Binance’s spot volume market share surging to 58% on July 23, has further strengthened the premier cryptocurrency’s $117,000 support.

Related Reading

This marks the second notable spike in Binance’s spot market dominance this month. On July 18, Binance’s share surged to 60%, coinciding with Bitcoin holding above the critical $117,000 mark on the daily chart.

Since then, the $117,000 level has served as a reliable support zone, likely buoyed by Binance’s deep liquidity and high execution reliability. Price stability at this level has been observed multiple times since the initial breakout.

In addition to this, Bitcoin’s price has shown strong resilience around the Realized Price of the 1-day to 1-week Unspent Transaction Output (UTXO) Age Band, which is currently near $118,300.

For context, UTXO age bands classify Bitcoin held in wallets based on how long it has remained unspent, offering insight into investor behavior. Shorter bands – 1 day to 1 week – typically reflect activity by newer or speculative holders, while longer bands – 6 months to 5 years – are associated with long-term holders with stronger conviction. Taha explained:

Historically, this metric acts as a dynamic support level, indicating that newer holders are not capitulating and that the average on-chain cost basis of recent buyers is being respected by the market.

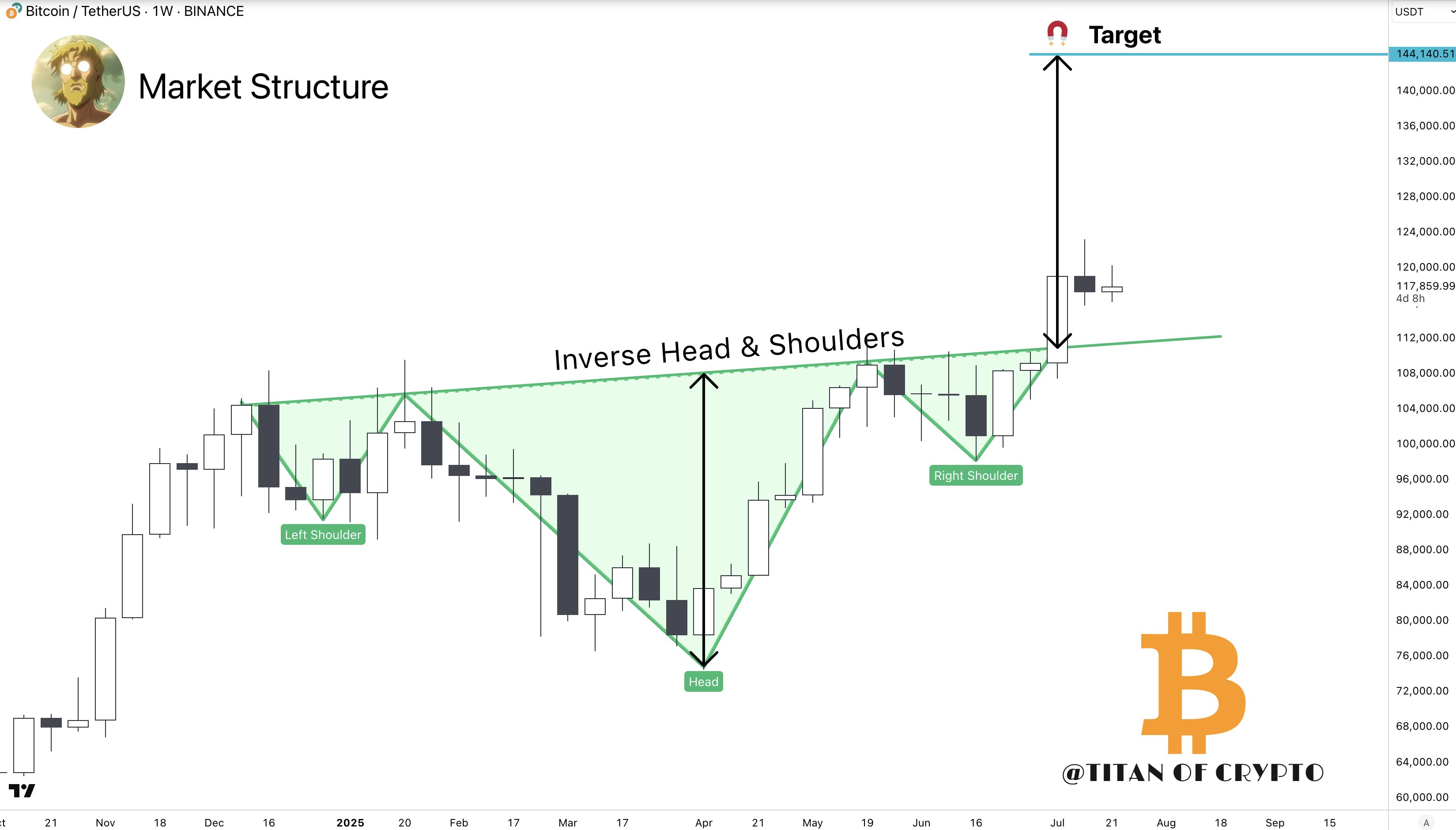

Meanwhile, fellow crypto analyst Titan of Crypto took to X to highlight BTC following the bullish inverse head and shoulders pattern. In an X post, the analyst shared the following weekly chart, adding that BTC is on track to hit a target of $144,000.

Will BTC Hit $180,000 By Year End?

Bitcoin’s recent all-time high (ATH) of $123,218 has reignited speculation around even higher price targets before year’s end. According to CryptoQuant analyst Chairman Lee, BTC remains on track to reach $180,000 by the end of 2025.

Related Reading

Recent on-chain metrics support this bullish outlook. Notably, the Bitcoin IFP indicator suggests that major holders continue to hold BTC despite its proximity to record highs – unlike in previous cycles, where exchange inflows typically preceded significant corrections.

However, not all indicators point upward. Exchange reserves recently reached their highest levels since June 25, raising concerns about potential sell pressure. At press time, BTC is trading at $119,097, up 0.6% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant, X, and TradingView.com

Source link

Ash Tiwari

https://www.newsbtc.com/bitcoin-news/bitcoin-rally-signal-analyst-links-binance-spot-volume-surges-to-price-upswings/

2025-07-25 04:00:58