As Bitcoin (BTC) continues to post new all-time highs (ATH), reaching as much as $118,869 on Binance, market indicators show little sign of overheating. The lack of retail-driven hype amid BTC’s record-breaking run suggests there may still be room for further growth in the flagship cryptocurrency.

Bitcoin ATH Sees Absence Of Hype

According to a recent CryptoQuant Quicktake post by contributor burakkemeci, Bitcoin’s current rally is notably characterized by the absence of retail investors. The contributor argues that this lack of retail participation implies BTC may still have significant upside potential.

Related Reading

The analysis centers on the Spot Retail Activity Through Trading Frequency Surge metric, which tracks the frequency of retail trading activity in the Bitcoin spot market. The analyst shared the following chart to illustrate the trend.

When retail trading activity rises significantly compared to the one-year moving average (MA), the chart forms bubbles. Green bubbles indicate that there are very few retail investors currently in the market.

Orange bubbles show that trading activity among retail investors is picking up. Similarly, red bubbles indicate caution, hinting that there are too many retail investors in the market and that it may be a good time to consider exit strategies.

As the below chart shows, retail activity remains subdued – even as BTC continues to reach new ATHs. In fact, the metric has stayed within the gray zone since March 2024, reflecting a lack of mass retail entry.

Historically, retail trading tends to surge as BTC approaches or exceeds ATH levels. The analyst notes that this absence may indicate the cycle top is still ahead:

The bull market is still largely driven by institutions and exchange-traded funds (ETFs). When retail finally enters the scene, that might mark the beginning of the final phase.

BTC Witnessing Subdued Selling Pressure

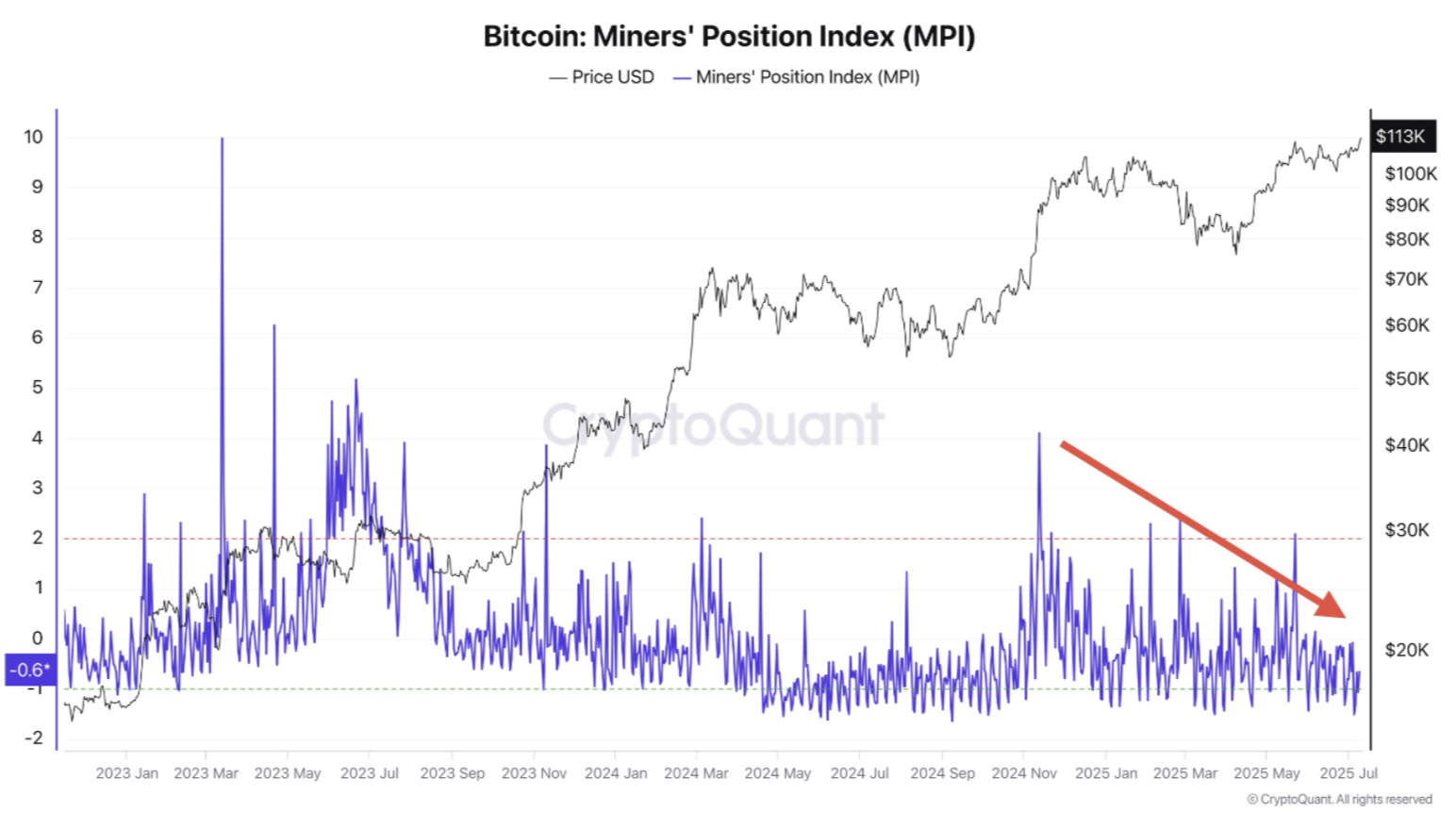

In addition to the low retail presence, other on-chain indicators suggest that Bitcoin’s current rally is not overheating. For example, the Miner Position Index has been declining since November 2024, implying reduced selling pressure from miners.

Another key metric, the Market Value to Realized Value (MVRV) ratio, is holding steady around 2.2 – below the 2.7 levels observed during ATHs in March and December 2024. Recent analysis predicts the next significant resistance may emerge at around $130,900.

Related Reading

Despite weak selling pressure and limited retail activity, some recent exchange trends hint at the possibility of a short-term pullback. At the time of writing, BTC is trading at $117,746, up an impressive 6% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com

Source link

Ash Tiwari

https://www.newsbtc.com/bitcoin-news/no-mania-yet-bitcoin-ath-lacks-hype-suggesting-further-upside-potential/

2025-07-12 02:00:54