Ethereum (ETH) is up 4.2% over the past seven days, trading in the mid-$2,500 range at the time of writing. Although the digital asset remains down 19% on a year-over-year (YoY) basis, some analysts are optimistic that it’s ready for a liftoff.

Ethereum Enters Wyckoff ‘Liftoff’ Phase

In an X post published today, crypto trader Merlijn The Trader noted that Ethereum appears to be following the Wyckoff Accumulation pattern and has successfully cleared both the ‘creek’ and ‘spring’ phases, potentially entering the ‘liftoff’ phase characterized by parabolic price action.

Related Reading

In the Wyckoff accumulation pattern, the ‘creek’ represents overhead resistance where price struggles to break higher, while the ‘spring’ is a false breakdown below support, meant to trap bears and confirm strong hands. The ‘liftoff’ phase follows the spring, marked by a sharp recovery and breakout above resistance, signaling the start of a new bullish trend.

The analyst shared the following Ethereum daily chart, which shows the cryptocurrency on the verge of a potential breakout, with its next major resistance at the $3,700 level. A successful breakout and retest of this level could set the stage for a new all-time high (ATH).

Fellow crypto analyst Crypto GEMs also pointed toward Ethereum getting ready for a significant move to the upside. The analyst shared the following chart which compares ETH’s price action in 2025 to that in 2024.

If Ethereum mirrors its 2024 performance, it could break above the $3,000 mark in the near term. However, not all analysts share this bullish outlook.

For instance, noted crypto analyst Carl Moon shared a four-hour Ethereum chart showing the asset trading within a rising wedge pattern. He cautioned that unless ETH breaks out of this formation, it may face a drop to $2,200.

To explain, a rising wedge pattern is a bearish chart formation where price moves upward within converging trendlines, indicating weakening bullish momentum. It often signals an upcoming breakdown, as buyers lose control and sellers push the price lower after the wedge is breached.

ETH Network Sees Renewed Activity

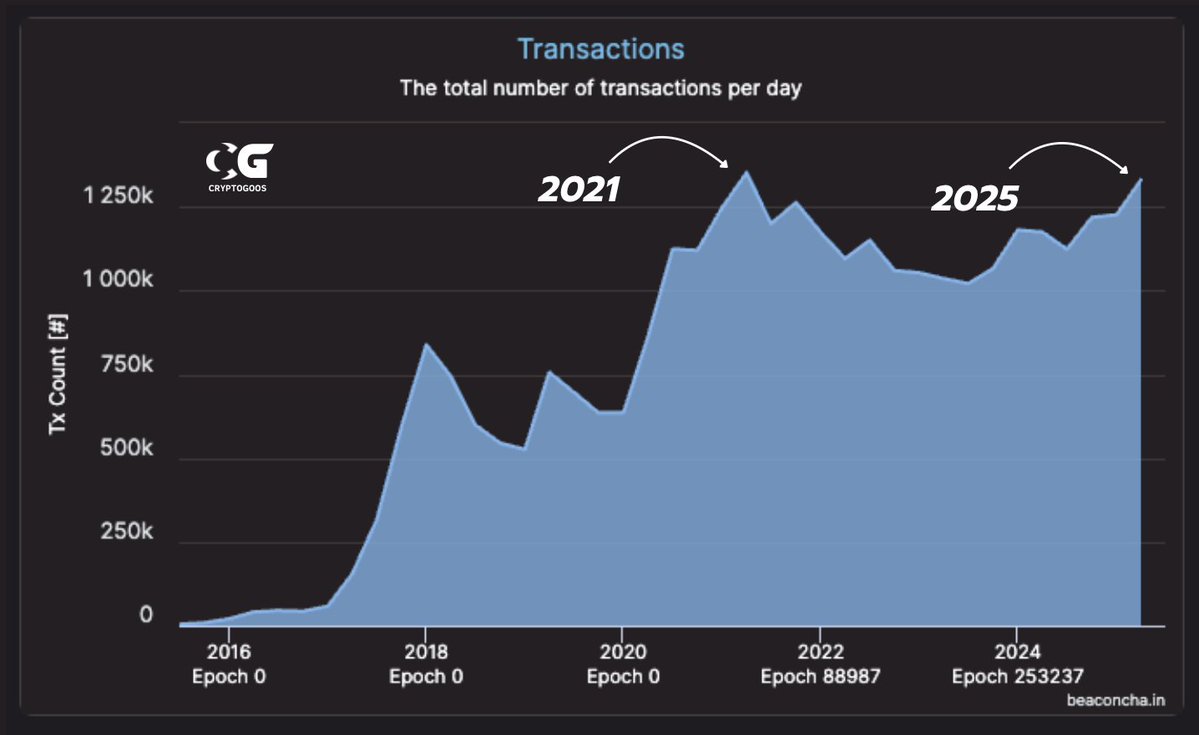

In a separate X post, crypto analyst CryptoGoos remarked that daily transactions on Ethereum are nearing ATH level for the first time since 2021. Typically, heightened network activity tends to precede major price movements.

Analyst Crypto Rover echoed this view, noting that active addresses across the Ethereum network have hit a new all-time high. They added that ETH below $3,000 is “an absolute steal.”

Related Reading

Meanwhile, Ethereum liquid staking is also inching toward historic levels, with 35.5 million ETH now locked. At press time, ETH trades at $2,522, down 3.8% in the past 24 hours.

Featured image from Unsplash, charts from X and TradingView.com

Source link

Ash Tiwari

https://www.newsbtc.com/ethereum-news/ethereum-approaches-wyckoff-liftoff-phase-can-eth-reach-a-new-high/

2025-07-05 03:00:53