Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP is inching toward what could be its most consequential technical inflection in more than a year, according to the June 3 video analysis from the YouTube channel More Crypto Online (MCO). Employing classical Elliott-wave mapping, the analyst argues that XRP has been building a five-wave advance ever since the market reset in July 2023 and is now attempting to ignite the terminal “fifth” wave—a rally that, if it unfolds under euphoric conditions, could extend as far as $9.

How The Roadmap Is Built For XRP

“We might be in a process of upside reversal… It’s like a now-or-never moment,” the commentator told viewers, stressing that breakouts are usually obvious only after large portions of the move are already spent. In Elliott wave terminology the market is said to be preparing for a smaller-degree third wave inside the larger fifth, “normally the most aggressive one,” he noted, pointing to the explosive impulse that followed a similar set-up last year.

Related Reading

On MCO’s primary chart the July 2023 trough serves as the wave-four low of an even larger advance. From there, a series of lower-degree one-two formations appears to have carried XRP into wave three and, more recently, into a sideways, three-legged correction that completed in April. “We have a wave 1, a wave 2, a wave 3, the wave 4, and maybe this is now the fifth wave that’s unfolding,” he explained, adding that wave four’s depth and duration were textbook for a counter-trend pause.

To translate wave counts into price objectives the analyst measured waves 1 through 3 and projected the classic 61.8 percent Fibonacci extension from the bottom of wave 4. That calculation yields $6.20 as a “straightforward” fifth-wave target. The same measurement’s 78.6 percent extension sits at roughly $9.00, a level the commentator said “sometimes materialises in a very euphoric fifth wave.”

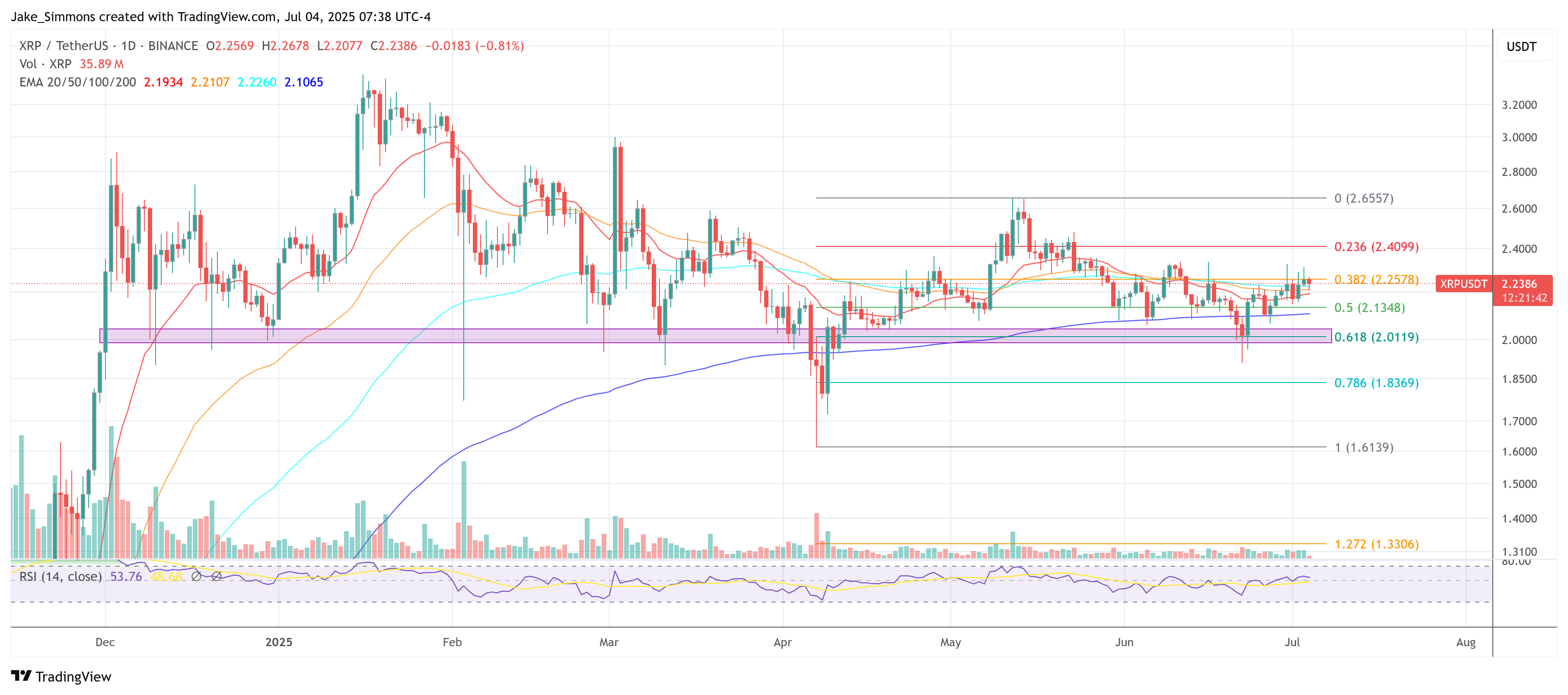

Before any discussion of $5-plus prices becomes actionable, XRP must clear a cluster of near-term hurdles. The analyst identifies the $2.30–$2.40 range as the first structural ceiling; it coincides with a descending trend-line that has capped every rally since March and with the 100-day exponential moving average.

Related Reading

The shorter-time-frame wave count shows why this band matters. From the 7 April swing low the market printed a clear five-wave micro-structure, implying that a fresh up-trend may already be underway. Yet, as the analyst cautioned, “We still have to clear all these previous swing highs… We’ve got resistance in this area around $2.30, structurally $2.40.” A decisive break above that shelf would validate a sub-wave (iii) target around $3.30–$3.50, the January swing-high zone the video calls “the next level.”

Bearish Scenario For XRP

Every Elliott-wave blueprint comes with an invalidation level. In the MCO model the entire fifth-wave scenario survives only if price holds above the April nadir—the start of wave 1 in the current one-two set-up. At the micro level the bulls must also defend what the video labels “the $1.99 support area.” A deeper retracement to $1.60 (the “red dotted line”) could be tolerated inside an extended wave 2, but any sustained trade beneath that mark would probably mean wave 4 is still developing, pushing back the timetable for a breakout.

“As long as we’re holding above the April low, this pathway higher remains valid and plausible,” the analyst reiterated. Conversely, a failure there would force a re-evaluation of the entire count.

Although the headline $9 print grabs attention, the analyst is clear that such an extension presupposes an extreme sentiment shift. Historically XRP’s rallies have often stalled near the 61.8 percent projection, and the channel’s host reminds viewers that “market sentiment” ultimately decides whether the 78.6 percent extension is reachable.

For now the focus is squarely on securing an impulsive close above $2.40 and then on challenging the mid-$3 region. Only once that campaign succeeds will the discussion move seriously toward $5.65, $6.20 and, in a parabolic climax, the high-single-digit zone.

At press time, XRP traded at $2.23.

Featured image created with DALL.E, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/xrp-news/xrp-could-hit-9-in-euphoric-fifth-wave/

2025-07-04 21:00:23