Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

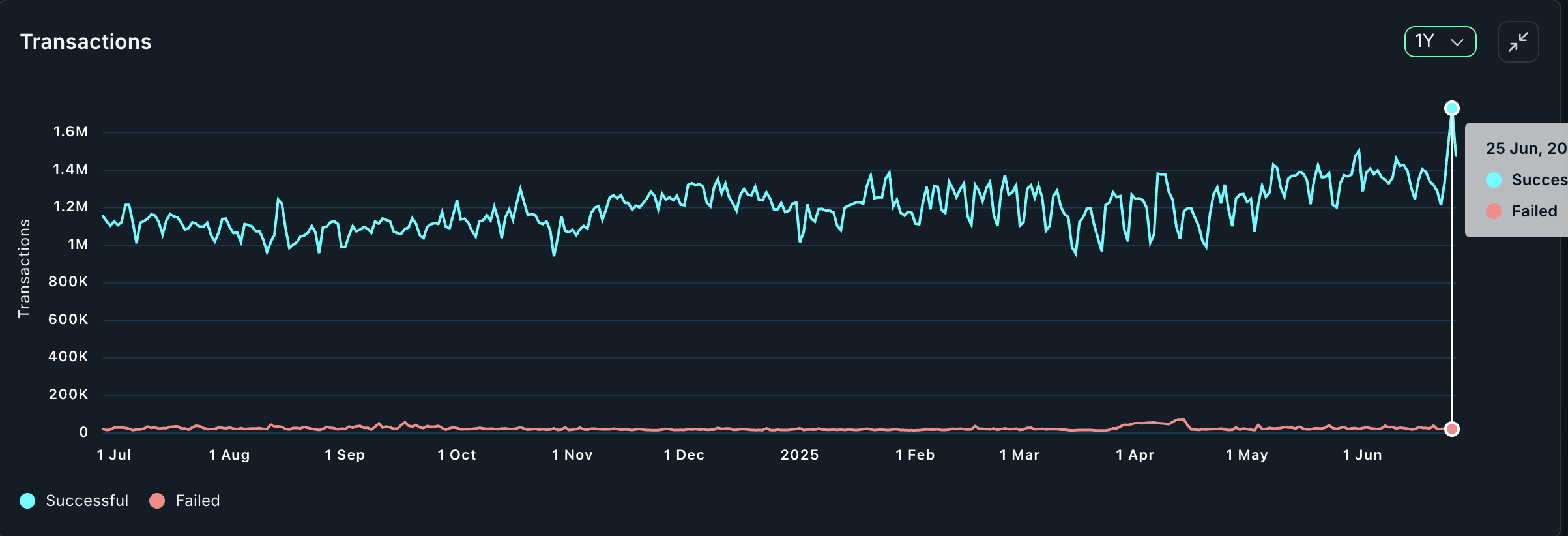

Ethereum has seen a notable spike in its daily transactions after a week filled with uncertain market movement. While the rise in the daily transactions has caught attention, what is really essential to point out is that it has been a long time since the daily transactions have been this high. In fact, the spike has led to the highest level that Ethereum’s daily transactions have been in over 16 months, showing a return to the blockchain that seemed previously abandoned.

Ethereum Daily Transactions Cross 1.7 Million

According to data from the on-chain data aggregation website, Nansen, the Ethereum daily transaction count has spiked by almost 50% over the last few days. The week had begun with the daily transaction count sitting at 1.2 million on Monday. However, by Wednesday, this figure was already changing rapidly to reach new yearly peaks.

Related Reading

As the Ethereum price rose above $2,400, so did participation on the blockchain, leading daily transactions to rise to 1.729 million. This sharp spike has led to the highest level so far in 2025, and is the first time since January 2024 that the daily transactions has crossed the 1.7 million mark.

At the same time, there was also an unusual spike in the daily active addresses, which rose by almost 50% as well in the same time period. The daily active addresses rose from 345,406 addresses to 593,637 addresses in the space of four days.

All of these have happened as the Ethereum price has recovered, suggesting that the spike in on-chain participation is actually more from investors buying than selling. If this trend continues, then it could send the Ethereum price soaring higher from here.

Sell Volume Begins Dominating ETH Price

In contrast to the rise in Ethereum on-chain participation, there has also been an increase in the on-chain sell volume compared to the buy volume. Nansen data points out that in the $168.37 million on-chain buy volume recorded in a 24-hour period, approximately $78.15 million was going toward buys, while a little over $90 million was from sellers.

Related Reading

Furthermore, when it comes to individual transactions involved in buying and selling Ethereum, the sellers remain in the lead. There were more than 52,000 buy transactions recorded during this period, with around 24,300 buyers. While the sell transactions ran up towards 74,000, with sellers at more than 32,000. This shows a higher percentage of sellers compared to buyers, which would explain why the price has been unable to reach other support levels.

This rise in the selling volume suggests that the buys are not enough to absorb the selling volume. This could fight off any buying momentum that could lead to a price recovery and keep the Ethereum price down while the crypto market struggles to find its footing.

Featured image from Dall.E, chart from TradingView.com

Source link

Scott Matherson

https://www.newsbtc.com/news/ethereum/ethereum-daily-transactions/

2025-06-28 06:30:27