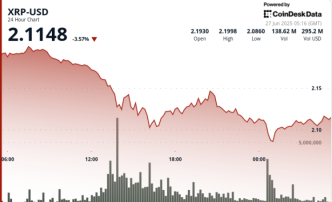

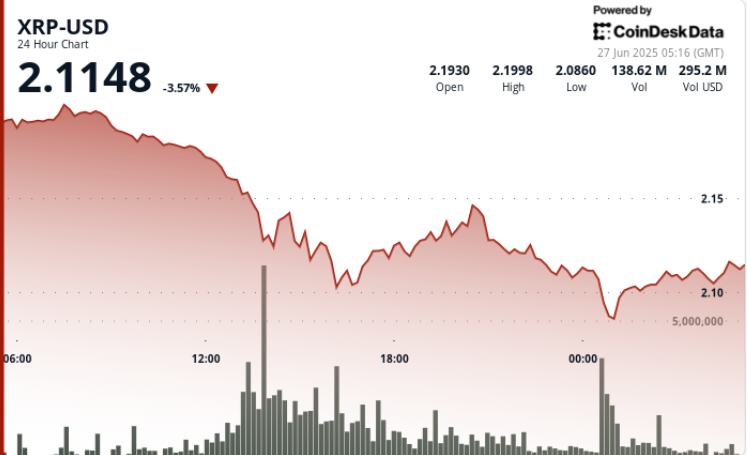

XRP faced sharp downside pressure over the last 24 hours, falling 5.3% despite large-scale whale activity and easing geopolitical tensions.

The asset dipped from $2.21 to a session low of $2.08 before a modest recovery to $2.10.

While the broader crypto market attempted to stabilize following ceasefire agreements in the Middle East, XRP’s momentum remained fragile, with technical resistance building at $2.17.

News Background

- Market sentiment improved slightly after former U.S. President Donald Trump reportedly helped broker a ceasefire between Iran and Israel, calming some investor fears.

- Despite that, XRP struggled to hold recent gains as traders reacted to large on-chain movements. Ripple transferred $439 million worth of XRP to an unknown wallet, and other whale wallets moved another $58 million to centralized exchanges — raising questions about potential distribution or internal reshuffling.

- Although these events drew attention, the token’s inability to reclaim $2.14 resistance signals underlying bearish momentum.

- Technical analysts continue to monitor XRP’s descending channel pattern, with expectations for a breakout or breakdown between July and September. For now, the $2.08-$2.09 zone remains a critical level to hold.

Price Action

XRP dropped from $2.21 to $2.10 over the 24-hour period, marking a 5.3% decline within a $0.13 range. The steepest selloff occurred between 12:00 and 16:00 UTC on June 26, with back-to-back hourly volume surges above 99 million XRP as price fell to $2.10. Resistance formed clearly at $2.17, with multiple rejection wicks above $2.12 later in the session.

By midnight UTC, XRP had revisited its session low of $2.08. A modest bounce followed in the final hour of the session, as price climbed from $2.09 to $2.10, with short-lived momentum topping at $2.105. A drop in volume late in the session suggests buyer fatigue, though the $2.08 support zone held firm.

Technical Analysis Recap

• XRP declined 5.3% from $2.21 to $2.10, with a total intraday range of $0.13

• Heaviest selling occurred from 12:00–16:00 UTC on volume over 114M and 99M XRP

• Strong resistance formed at $2.17; key support tested at $2.08–$2.09

• Recovery attempts failed at $2.14 and $2.12 before settling around $2.10

• Final hour showed modest 0.54% gain from $2.09 to $2.10, with volume spiking to 930K XRP during 01:42–01:45

• Consolidation near $2.10 in final 15 minutes suggests short-term stabilization

Source link

Shaurya Malwa

https://www.coindesk.com/markets/2025/06/27/xrp-slides-5-as-selling-pressure-intensifies-despite-whale-transfers

2025-06-27 05:30:50