Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Bitcoin price could be entering the final and most explosive phase of its current market cycle, as an analyst maps out the cryptocurrency’s next movements onto a parabolic step-like structure. Reinforcing this bullish outlook is the Elliott Wave 5 count, which points to an epic price rally that could propel Bitcoin above $300,000, eclipsing its previous all-time high and current market value by a substantial margin.

Bitcoin Price Ultimate Parabolic Push Unveiled

A newly released Bitcoin price forecast by X (formerly Twitter) crypto analyst Gert van Lagen boldly suggests that the leading cryptocurrency may be on the verge of its most aggressive bull run this cycle. Lagen’s price chart indicates that BTC is firmly locked into a parabolic step-like growth structure, potentially eyeing an extended Wave 5 breakout that could drive prices well beyond $345,000.

Related Reading

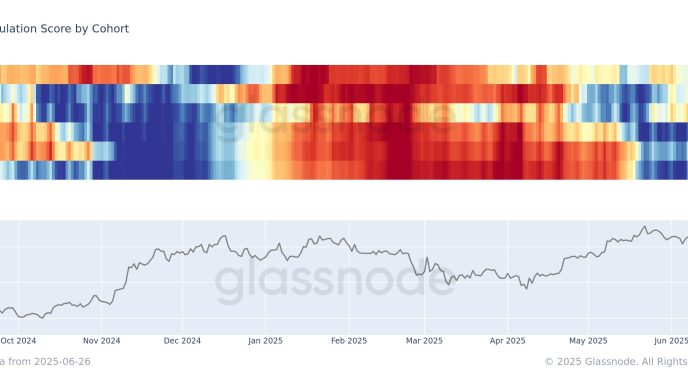

The trajectory of the analyst’s chart illustrates a clear parabolic growth curve anchored by four distinct formations, labeled Base 1 through Base 4. Each of these bases represents a phase of accumulation and consolidation that preceded a Bitcoin price breakout. This structure also mirrors a textbook parabolic setup, where each new base sets the stage for steeper upward moves.

Most notably, after the completion of Base 3, marked by the inflection point on the chart, Bitcoin launched into a sharp rally, confirming the expected parabolic behavior. Lagen’s analysis now indicates that BTC’s current Base 4 has been completed, followed by a corrective A-B-C structure that appears to have reached its bottom, positioning the cryptocurrency for the anticipated final leg of its cycle.

Using Elliott Wave theory, Bitcoin’s price action is still unfolding within the fifth wave, which is the final advance in the five-wave impulsive cycle. The price chart identifies Wave 1 as beginning shortly after the 2022 lows. This was followed by a powerful breakout in 2023, which defined Wave 3, while Wave 4 concluded more recently with a classic corrective pattern. Notably, the upcoming Wave 5 could see Bitcoin skyrocket anywhere between $300,000 and $425,000, depending on the timing and strength of its bullish momentum.

Timeline For Game-Changing Rally

A key element in Lagen’s analysis is the dynamic “sell line” drawn near the upper end of the parabolic arc that runs underneath the Bitcoin price movement on the chart. According to the analyst, the longer it takes for Bitcoin to hit this projected vertical trajectory, the higher the price at which the potential market top might occur. This is due to the upward curvature of the parabolic trend line itself, which steepens over time.

Related Reading

Currently, Lagen forecasts an early breakout by July 7, 2025, if momentum resumes immediately. However, if Bitcoin continues consolidating through the summer, the projected peak could rise further, as the sell line would continue climbing over time.

Featured image from Pixabay, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/bitcoin-price-above-300000/

2025-06-26 23:30:21