Bitcoin (BTC) could be primed for a surge to $160,000, according to a key on-chain metric that foreshadowed two other record-breaking rallies.

This bullish outlook is emerging even as BTC battles volatility near $108,000, a psychological threshold tested amid geopolitical turbulence and conflicting accumulation patterns.

The Accumulation Blueprint

In his latest analysis, market watcher Axel Adler Jr. pointed out that Bitcoin’s Long-Term Holder (LTH) to Short-Term Holder (STH) ratio shows a very familiar accumulation pattern.

According to him, some of BTC’s most explosive rallies between 2023 and 2025 were preceded by sustained LTH/STH growth. One of the runs, which started when Bitcoin was trading around the $28,000 level, saw the king cryptocurrency go all the way to $60,000. Another LTH/STH ratio uptick provided enough momentum to push BTC from $60,000 to $100,000.

Adler has noted the same signal flashing at the $100,000 level:

“Today, at the $100K mark, we again see sustained growth in the LTH/STH ratio,” noted the expert. “This accumulation phase could last 4-8 weeks, after which, by analogy with previous cycles, a powerful upward reversal is likely.”

Applying a conservative 1.6x multiplier to Bitcoin’s current price, he projects a $160,000 target by the end of August.

Giving more credence to the outlook, prominent trader Titan of Crypto identified a bull flag formation on BTC’s daily charts, suggesting a potential breakout to $137,000. He added that the MACD indicator was also on the verge of a bullish crossover, a move often viewed as a trigger for price momentum shifts.

Technical and historical indicators also bolster Adler’s thesis. For instance, the Bitcoin Rainbow Chart places the crypto asset firmly in the “BUY” zone, a scenario comparable to November 2020, just prior to it setting off on a 450% ROI surge, and May 2017, before the same metric boomed 1,400%.

Market Outlook

This activity coincides with broader geopolitical and market forces. On June 25, Bitcoin briefly touched $108,000 following remarks by U.S. President Donald Trump on easing tensions in the Middle East.

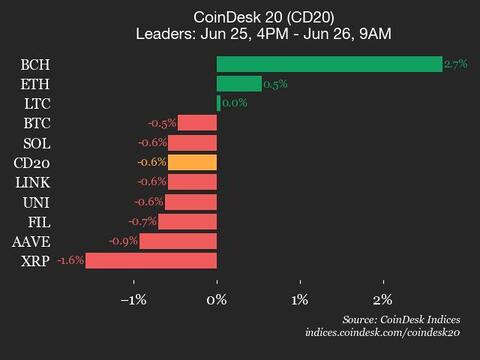

Prices have since cooled slightly, with BTC changing hands at around $107,653 at the time of this writing. While a modest 0.7% gain in the last 24 hours, the price reflects a 1.8% monthly dip.

Still, the asset’s nearly 3% uptick in the last seven days puts its performance slightly ahead of the rest of the crypto market, which only managed to go up 1.6% in that period. However, the sideways movement saw BTC underperform versus tech stocks like Nvidia (+9.15%) and Oracle (+32.5%), raising questions about capital rotation.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Source link

Wayne Jones

https://cryptopotato.com/last-time-bitcoin-did-this-the-price-went-from-60k-to-100k/

2025-06-26 13:03:29