According to exchange and on-chain data, global crypto markets plunged Friday as prices slid and forced a widespread sell-off. Bitcoin fell under $83,000, while Ethereum traded below $2,800. The breakdown sent roughly $2 billion of positions into liquidation, knocking confidence and prompting quick losses across major tokens.

Related Reading

Heavy Liquidations Rock Traders

Reports show more than 390,000 accounts were wiped out during the move. One single BTCUSD order on Hyperliquid stood out at $37 million, a sign of how fierce the selling became. Bitcoin bore the brunt: about $962 million of BTC positions were erased within 24 hours, with long bets making up nearly $931 million of that total. These figures underline how concentrated the damage was among those betting on higher prices.

Long Positions Versus Shorts

Long liquidations across the market approached $1.78 billion, while short liquidations were much smaller at close to $130 million. A rapid shift followed a strong US jobs report, which removed odds of a December rate cut and triggered roughly $450 million in liquidations in just two hours. That macro surprise appears to have fed directly into traders’ risk management systems.

Options Expiry Raises Stakes

Derivatives activity added pressure as more than $4.2 billion of crypto options were due to expire that day. Over 39,000 BTC options, valued near $3.4 billion, were on the docket. The longer-term put-call ratio sat at 0.52, but heavy recent put buying pushed the 24-hour ratio up to 1.36, signaling a burst of hedging.

The so-called max pain level for Bitcoin was around $98,000, well above where spot trades were happening. Ether options also featured prominently, with more than 185,000 contracts worth close to $525 million set to lapse. ETH’s 24-hour put-call moved to 1.01 from 0.72, and the options market’s max pain rested near $3,200, above spot prices near $2,800.

Altcoins Felt The Impact

The rout spread fast. Solana dropped 11% to about $126, while XRP slid more than 8% to roughly $1.91. Other tokens that fell in the wave included ASTER, HYPE, TNSR, DOGE, and ZEC. Selling was broad, showing that the move was not limited to one market or sector.

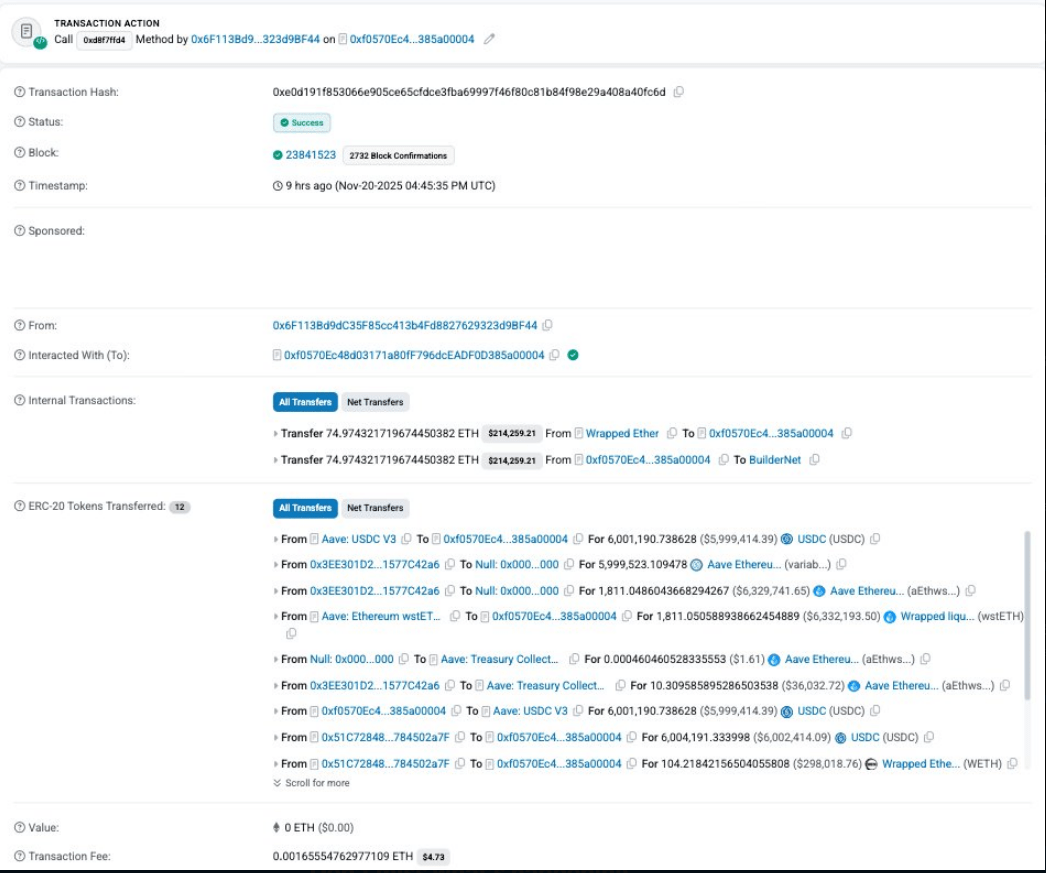

#PeckShieldAlert Following $ETH‘s drop below $2,900, a whale (0x3ee3…42a6) was liquidated on their long $wstETH position.

The position, which involved borrowing $USDC against $wstETH collateral, saw a total liquidation of $6.52M. pic.twitter.com/mv30VuXFfn

— PeckShieldAlert (@PeckShieldAlert) November 21, 2025

Whale Losses Highlight Risk

On-chain monitors flagged big losses among sizable holders. PeckShieldAlert reported individual ETH liquidations in the range of almost $3 million to $6.50 million.

This Anti-CZ Whale just got liquidated in the market crash!

He was once a legend with nearly $100M in profit — now his profits have dropped to $30.4M.https://t.co/UR55h4gK7l pic.twitter.com/5Tnp9UVEae

— Lookonchain (@lookonchain) November 21, 2025

Related Reading

Lookonchain tracked a high-profile account, Machi, whose total paper losses topped $20 million and whose balance was reported at just $15,530 after the hits. Another large account, labeled the “Anti-CZ Whale,” also saw profits plunge on Hyperliquid.

Featured image from Unsplash, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/bitcoin/2-billion-gone-in-minutes-bitcoin-slide-shakes-crypto-world/

2025-11-22 04:00:00