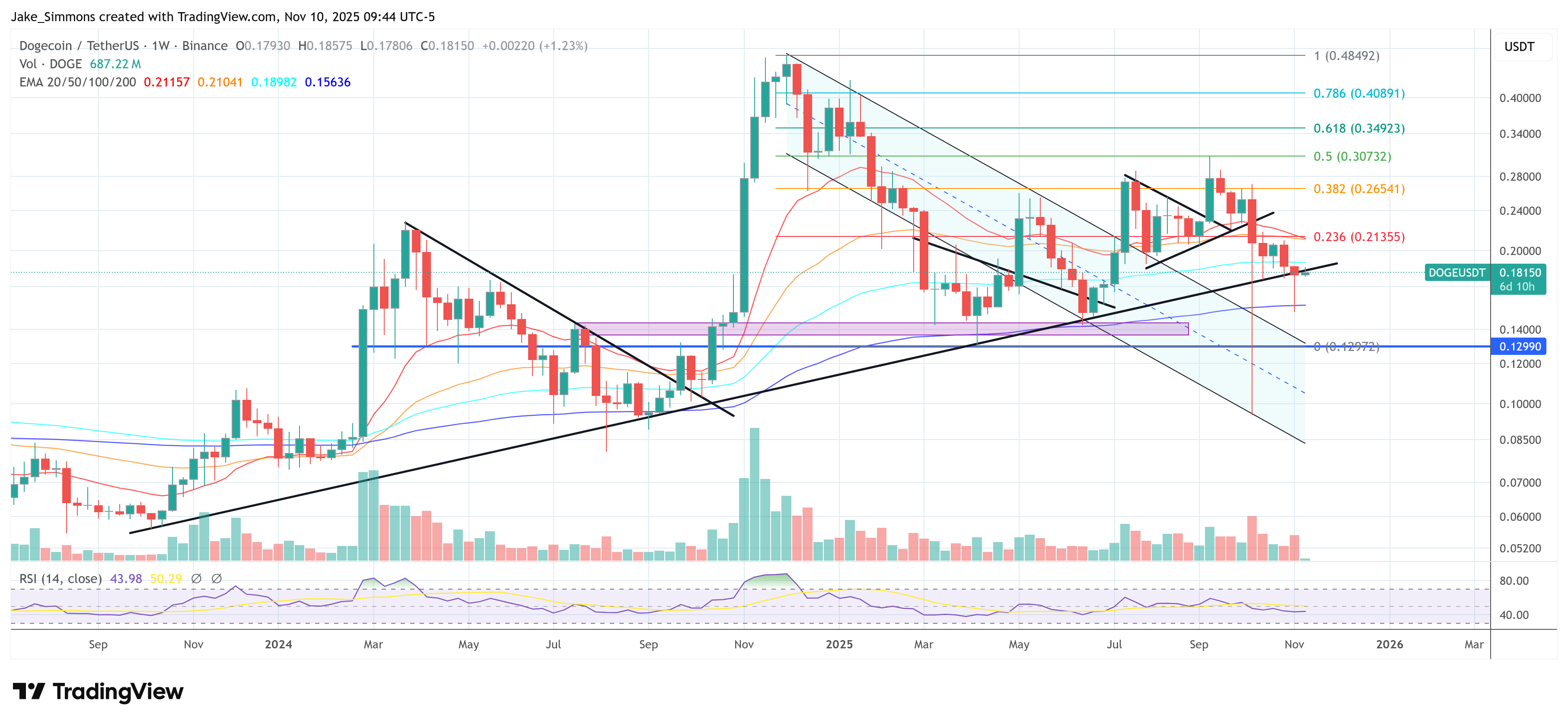

Dogecoin’s technical momentum is “back in the conversation,” with a revived pathway to $1 if current conditions hold, according to crypto analyst VisionPulsed in a November 10 video breakdown focused on DOGE’s structure and momentum profile. While he repeatedly underscored uncertainty around ultimate cycle timing, the analyst said Dogecoin has “reclaimed the uptrend,” adding that the macro uptrend looks broken but the summer uptrend is “valid technically,” especially when viewed on the weekly chart.

Dogecoin To $1 Still Possible?

VisionPulsed framed the setup as binary for risk takers: “Dogecoin’s road to the bull” if momentum confirms, versus a “path to the pig” near $0.06 if support breaks. He tempered expectations of euphoric targets, saying, “I’m not going to come on here telling you $5 Doge just yet. Let’s let it play out.”

VisionPulsed framed the setup as binary for risk takers: “Dogecoin’s road to the bull” if momentum confirms, versus a “path to the pig” near $0.06 if support breaks. He tempered expectations of euphoric targets, saying, “I’m not going to come on here telling you $5 Doge just yet. Let’s let it play out.”

Momentum—what he called “firepower”—was the core of his case. Scanning through multiple periods, he argued that stock RSI signals are broadly supportive on key charts: “We have the firepower to do it on the weekly time frame. We have the firepower now to do it on the daily time frame. If we go to the 2-day time frame, the firepower is there. If we go to the 3-day time frame, the firepower is almost there. If we go to the 4-day time frame, the firepower is there.”

Related Reading

He noted that the 5-day “still needs more time to reset,” the 6-day is “still resetting,” and the **10-day stock RSI gives us the chance to move higher.” On the 8-day, he said momentum has “just [been] attempting to curl up”—a posture that previously preceded upside bursts during this cycle.

Even as he spotlighted constructive internals, the analyst did not dismiss larger-timeframe risks. He characterized the two-week view as “maximum bearish,” while reminding viewers that similar conditions in 2023–2025 did not prevent sharp upside reversals: “There’s no rule that says we have to stay down here.” In his view, if momentum confirms and support holds, “technically the bull market resumes,” whereas a failure at key levels would “confirm a bear market.”

For Dogecoin specifically, VisionPulsed said the coin has “regained the uptrend,” distinguishing between what he sees as a broken macro structure and a still-intact summer trendline on higher timeframes. Should momentum continue to build, he argued that DOGE could “move to the top of the channel,” echoing a pattern he has flagged repeatedly this year: “Every time [support] holds… each time Doge has had an explosive move to the upside.” Still, he avoided definitive timing: “If no one knows where the top is, then technically we don’t even know what the deadline is for Doge to come up here.”

Related Reading

The analyst’s broader cycle take remained intentionally agnostic. He acknowledged previously calling for a potential cycle top earlier in the year, then noted that a break to fresh highs would invalidate the popular “150-day from the bottom” top-timing theory: “If we break the high, that theory gets invalidated. And then the question becomes, where is the top? And we can say we don’t know.” That uncertainty, he suggested, is precisely why the market could surprise to the upside if momentum reasserts itself.

The near-term action item, in his telling, is straightforward: watch momentum follow-through from oversold RSI conditions across the daily to 10-day bands, and respect the risk that a failed confirmation flips the script. As he put it in closing, “We’re rooting for the bull run to continue. We have the momentum for it to continue and as long as we stay over the moving average in my opinion it will continue.” But the fork remains visible: “Dogecoin’s road to the bull” if support holds and momentum confirms—or the “path to the pig” if it breaks.

At press time, DOGE traded at $0.1815.

Featured image created with DALL.E, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/news/dogecoin/dogecoin-1-target-back-in-play/

2025-11-11 02:00:00