According to the latest on-chain data, XRP’s open interest has returned to a low similar to the one seen in May 2025. Below is the potential implication for the XRP price.

Derivatives Activity Sees Significant Dip — What This Means

In a Quicktake post on the CryptoQuant platform, on-chain analyst PelinayPA delved into the underlying activity within the XRP derivatives market and how it could affect the altcoin’s price in the coming weeks.

Related Reading

The analyst’s report revolved around results obtained from the Open Interest metric, which tracks the total amount in USD of derivatives contracts of a cryptocurrency (XRP, in this case) that are open and have not been settled at a given time.

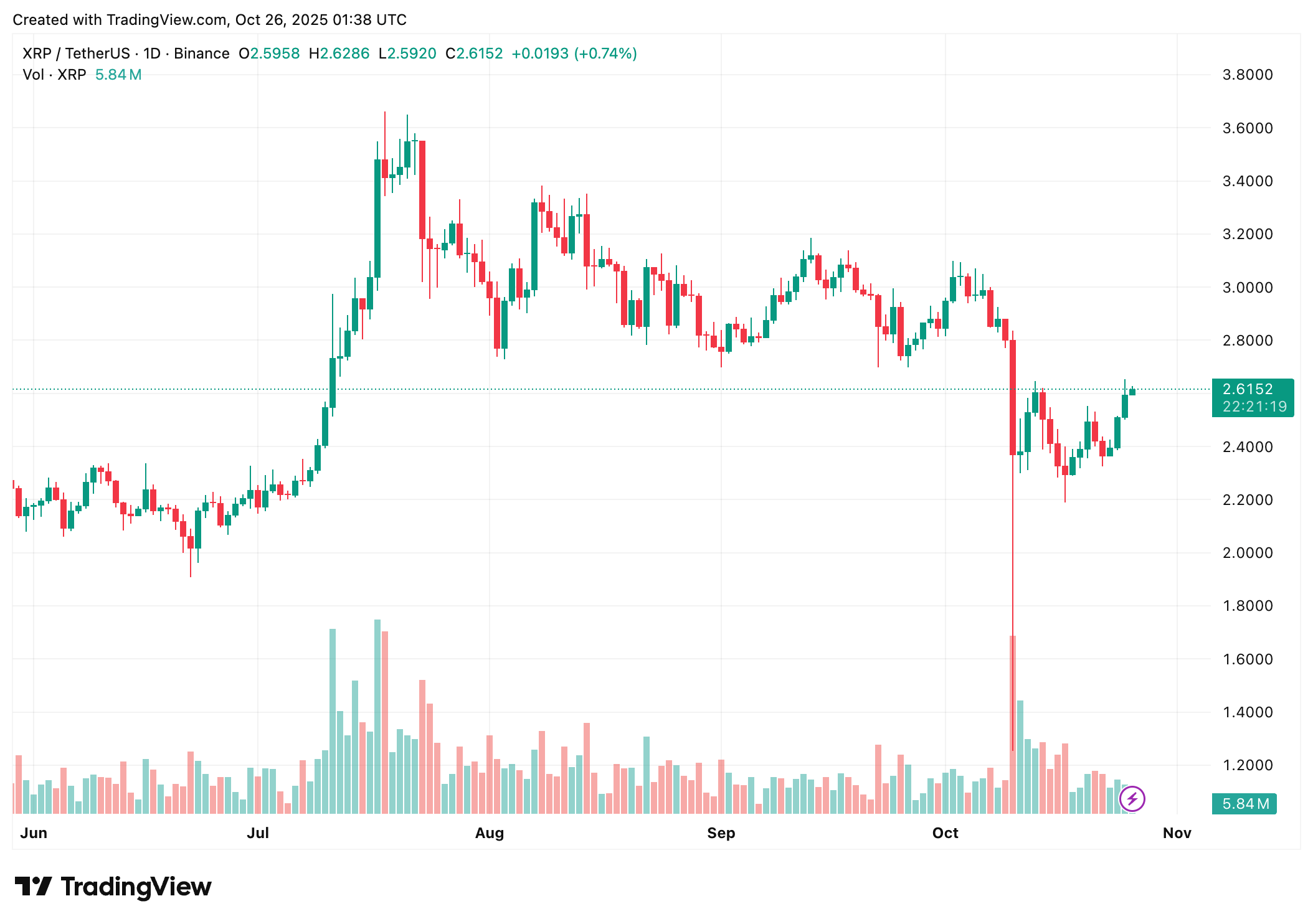

According to PelinayPA, the Open Interest metric has fallen to a level as low as that seen in May 2025. Interestingly, this latest dip in OI coincides with the XRP price being around $2.50, which is a much higher valuation than was held during the previous OI nosedive.

Usually, a decline in a cryptocurrency’s Open Interest indicates the forceful removal of over-leveraged or speculative positions from the market, leaving only the stronger hands to rule the market.

After the OI bottomed in May 2025, there was a significant increase in trading volume, which pushed the price to as high as $3.50. As the open interest has fallen to a level similar to that of May, history could very well repeat itself, and the XRP price could begin yet another upward rally.

XRP Key Zones To Watch Out For

For hopes of an XRP rally to remain within realistic possibilities, PelinayPA directed attention towards a couple of important price ranges to monitor. Firstly, the analyst started with the important support zone, which is the $2.20-$2.40 price range. According to the analyst, this support zone serves as a short-term buy zone, which will be crucial in keeping the token in an uptrend.

A breach of the $2.20-$2.40 support could cause a short-term sell to as low as $1.85, where the next major support for the XRP price lies. In the scenario where this “key support” fails, the altcoin could plummet to as low as its major psychological floor of $0.60-$0.70.

Looking towards the more probable bullish scenario, a condition would have to be met for the XRP price to see a surge. First, a sustained open interest increase of around 25% for several days would confirm the start of a new move.

If this happens, investors could witness a breakout above the first resistance within the $2.80-$3.00 range, strengthening bullish momentum. Also, a breakout above $3.30-$3.50 could trigger a price discovery phase, where the XRP price surges towards $4.20-$4.50.

As of this writing, XRP holds a valuation of about $2.61, reflecting an over 2% jump in the past day.

Featured image from iStock, chart from TradingView

Source link

Opeyemi Sule

https://www.newsbtc.com/analysis/xrp/xrp-open-interest-return-to-may-2025-low/

2025-10-26 09:30:00