Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Canada’s newest altcoin exchange-traded funds have raced to category leadership, with the Solana-focused SOLQ crossing C$300 million in assets under management (AUM) and the XRP-focused XRPQ topping C$150 million, according to a Tuesday announcement. The issuer said both funds now hold the largest AUM in their respective categories among Canadian peers, underscoring a sharp acceleration in institutional and retail demand for regulated exposure to Solana and XRP.

Investor Demand Surges For 3iQ’s SOL And XRP ETFs

SOLQ, a Toronto Stock Exchange–listed Solana staking ETF that debuted in April, benefited from marquee early allocations. The firm disclosed a lead investment from SkyBridge Capital and additional commitments from ARK Invest, which bought SOLQ through its ARKW and ARKF ETFs—moves it touted as the first US-listed ETFs to gain exposure to Solana and its staking rewards via a Canadian vehicle. Management fees on SOLQ remain waived until April 2026, the issuer added.

Related Reading

XRPQ launched in June and, with a 0% management fee for its first six months, has quickly scaled to more than C$150 million AUM; the Toronto Stock Exchange’s new-issuer log shows the product coming to market on June 18, 2025. The issuer said Ripple participated as an early investor.

“The momentum behind SOLQ and XRPQ demonstrates that Canadian investors and global leaders in the digital asset space are embracing secure, transparent, and regulated access to digital assets,” said Pascal St-Jean, the issuer’s president and CEO. “As the market leaders, these ETFs exemplify [our] commitment to meeting investor demand while setting a benchmark for innovation in the global market.”

Related Reading

The rise of these funds comes amid a broader wave of Canadian altcoin ETF launches this year. Multiple issuers have introduced spot Solana products—some with staking features and introductory fee waivers—while the domestic XRP lineup has also expanded, creating a competitive field against which SOLQ and XRPQ now claim the AUM crown.

Institutional signaling has been a secondary driver. ARK’s purchase framed SOLQ as a vehicle for capturing both SOL price performance and on-chain staking economics in a regulated wrapper. “Solana represents a high-performance blockchain infrastructure with significant potential for decentralized applications and finance,” ARK’s Cathie Wood said when confirming the investment earlier this year.

Contextually, Canada remains a first mover on listed crypto exposures beyond bitcoin and ether. In the United States, investors only recently gained a Solana ETF with staking economics via the REX-Osprey SSK product, while several US spot XRP ETF filings await regulatory decisions later in 2025—developments that help explain the cross-border interest in Canadian listings in the interim. A SSK-style Dogecoin ETF by REX-Osprey is set to launch this Thursday.

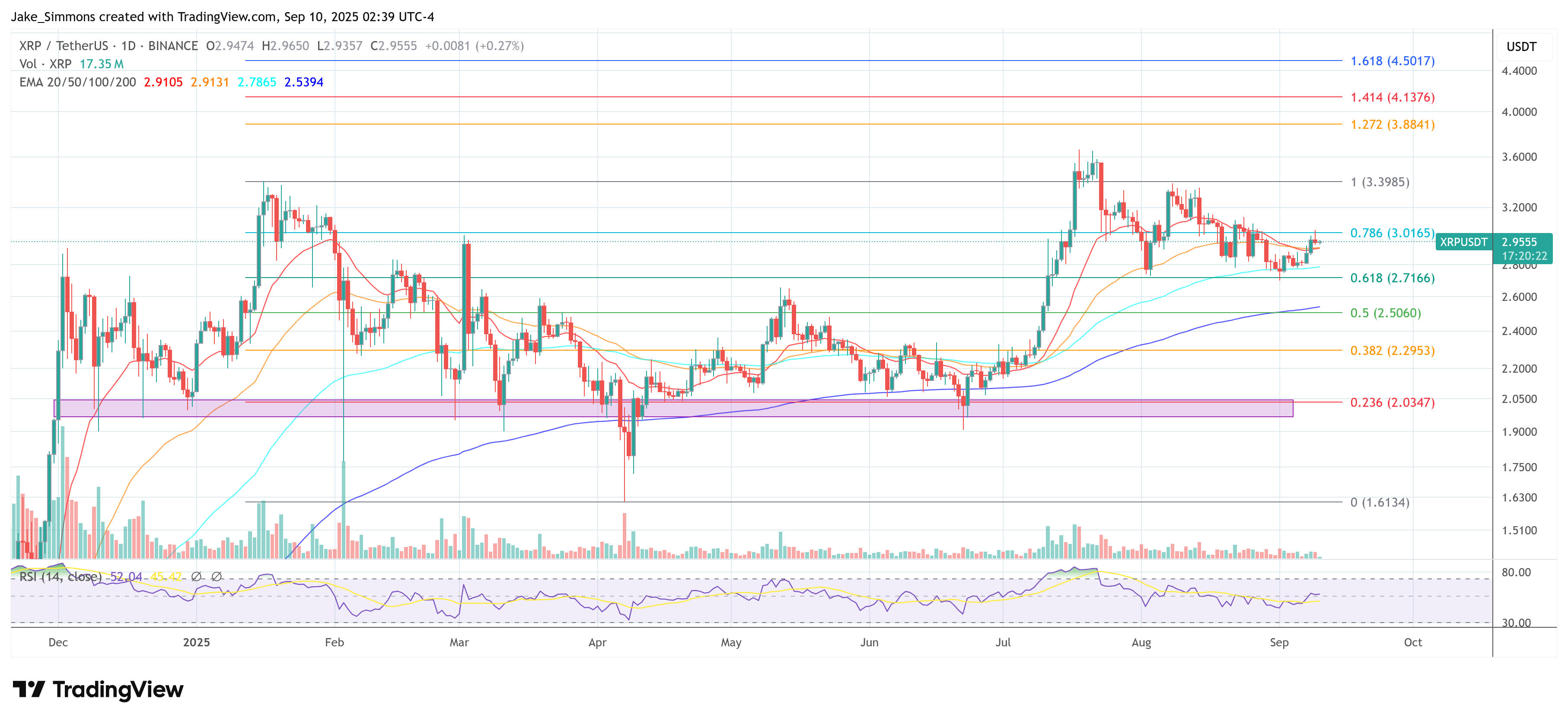

At press time, XRP traded at $2.955.

Featured image created with DALL.E, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/xrp-news/solana-xrp-etfs-smash-new-records-in-canada/

2025-09-10 10:00:00