Bitcoin’s (BTC) recent volatility has unsettled investors, as the largest cryptocurrency by market cap slid by more than five percent over the last two weeks. However, two key on-chain factors indicate that the BTC market structure is largely resilient.

Bitcoin Remains Strong Despite Volatility

According to a CryptoQuant Quicktake post by contributor XWIN Research Japan, two important on-chain indicators suggest that despite the recent slump in price, the overall market structure remains strong for the flagship cryptocurrency.

Related Reading

The first is Bitcoin’s Delta Cap – a long-term valuation model derived from the difference between Realized Cap and Average Cap – that has historically acted as a reliable floor during major cycles.

In early August, BTC traded above this steadily rising line, suggesting that the market is building a stronger foundation compared to previous drawdowns. A rising Delta Cap also signals capital inflows and long-term investor conviction, even during price corrections.

The CryptoQuant analyst shared the following chart showing Delta Cap hovering around $739.4 billion. Although BTC is currently trading below this line, a quick move to $120,000 would likely push the price back above it.

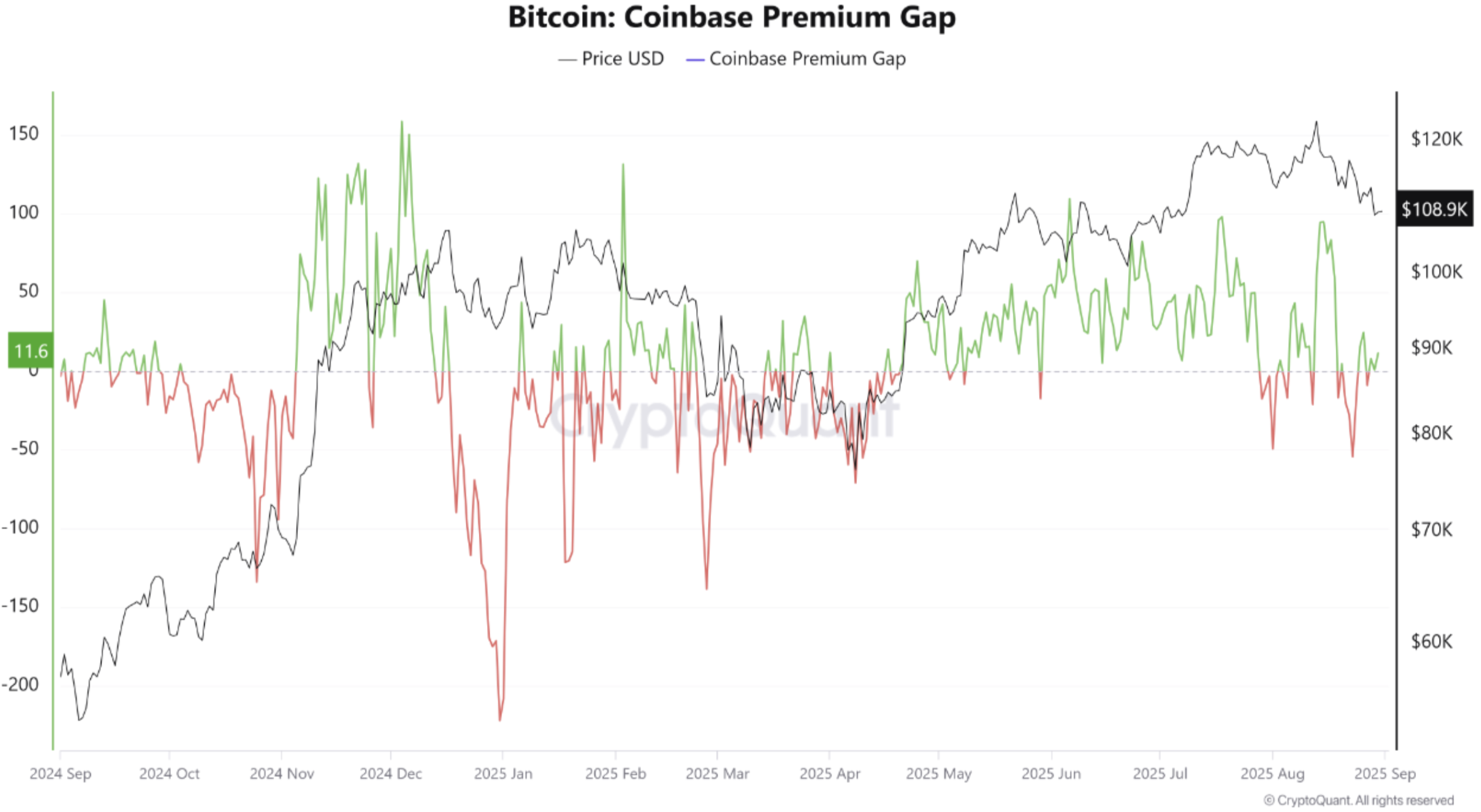

The second on-chain factor pointing toward resilience in BTC market structure is the Coinbase Premium Gap, which currently stands at +11.6. The high positive value of the metric suggests stronger demand from US institutions, who are accumulating BTC at a premium.

For the uninitiated, the Coinbase Premium Gap measures the price difference of Bitcoin between US exchange Coinbase and global exchanges like Binance. A positive gap means Bitcoin trades at a higher price on Coinbase, often signaling stronger US institutional buying demand.

Historically, sustained periods of positive premium have preceded major bullish phases, as institutional accumulation drives price discovery. The analyst concluded:

Together, these two metrics point toward a constructive setup: Bitcoin consolidating above $100K with strong institutional support and a long-term valuation floor steadily rising. Corrections, rather than being a sign of weakness, appear to be opportunities for accumulation within a robust structural uptrend.

Is BTC Out Of The Woods?

Although the two aforementioned on-chain indicators point toward strength in BTC market structure, not all analysts are as optimistic. For instance, a fall below $105,000 might send BTC all the way down to $90,000.

Related Reading

Another analyst recently warned that if BTC loses the support at $108,600 level, then it could fall further to $104,000. A failure to bounce from $104,000 could see BTC test the psychologically important $100,000 level.

That said, Bitcoin’s rapidly rising illiquid supply on Binance may play a pivotal role in sending it to a fresh all-time high (ATH). At press time, BTC trades at $109,289, up 0.9% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com

Source link

Ash Tiwari

https://www.newsbtc.com/bitcoin-news/bitcoin-delta-cap-coinbase-premium-gap-market/

2025-09-02 01:00:00